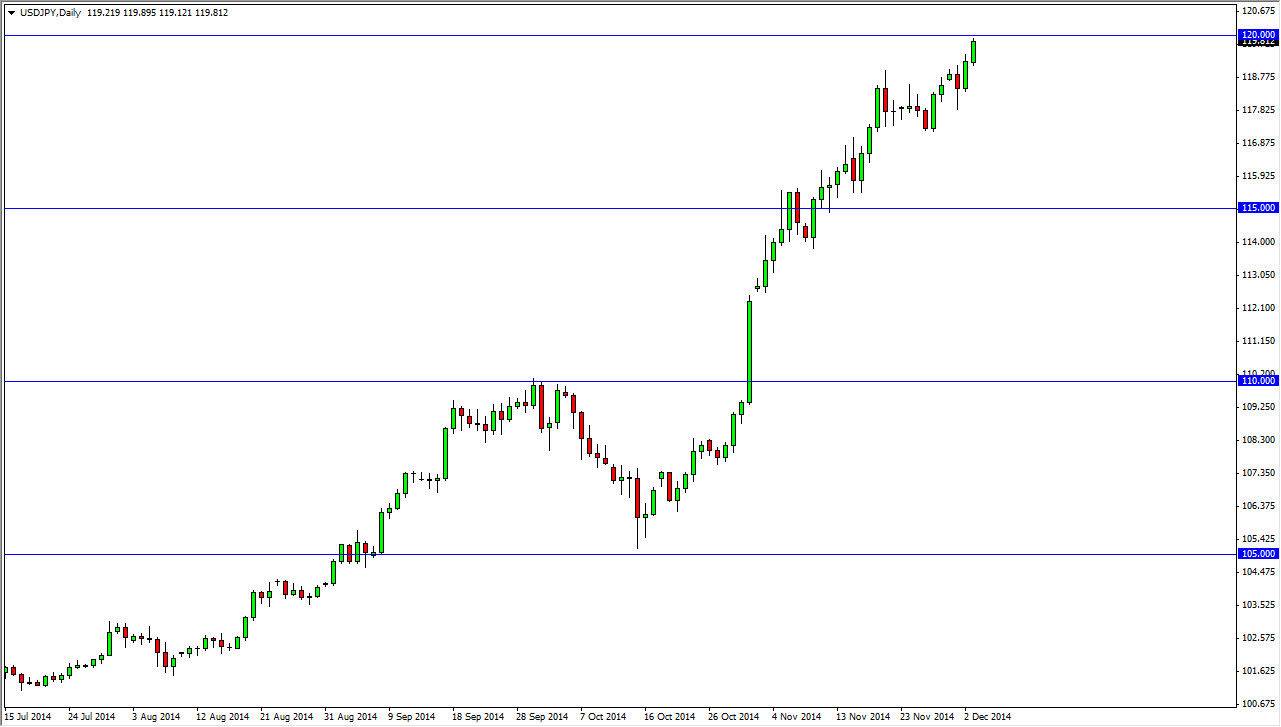

The USD/JPY pair broke higher during the course of the session on Wednesday, testing the 120 level. This is an area where we would anticipate seeing quite a bit of resistance though, so having said that I feel that a pullback could be coming. Ultimately, I feel that any pullback in this general vicinity should offer value, and it is very likely that this market is one that could be fairly quiet during the session, considering that the nonfarm payroll numbers come out during the session on Friday. With that, I look at pullbacks as value, but realize that I might get an even better entry price. I believe ultimately the market will break above the 120 level, signaling that the market wants to go much higher. I believe that this market will enter a longer-term buy-and-hold type phase, but we may need to pull back a little bit just to build up momentum to break above the psychologically significant 120 level.

This is a trend that should continue

I’ll see anything changing the trend of this currency pair at the moment. After all, the market continue to favor the US dollar over the longer term, simply because of the Federal Reserve stepping away from quantitative easing while the Bank of Japan continues to massively pump liquidity into the marketplace, thereby devaluing the Yen. With that being the case, I feel that this is a bit of a “perfect storm” and quite frankly most of the Forex market does as well. In other words, this is a very easy decision to make.

Every time this market pulls back, I think value as far as the US dollar is concerned. The 115 level is the floor as far as I can see, and as a result the markets will more than likely continue to attract more and more buying given enough time. I don’t even imagine a scenario in which the market can be sold, and as a result I’m not even looking for that trade currently.