USD/JPY Signal Update

Yesterday’s signals were not triggered and expired, as although the price did reach 120.08, there was no bullish price action there to justify a long trade.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm New York time, or after 8am Tokyo time.

Long Trade 1

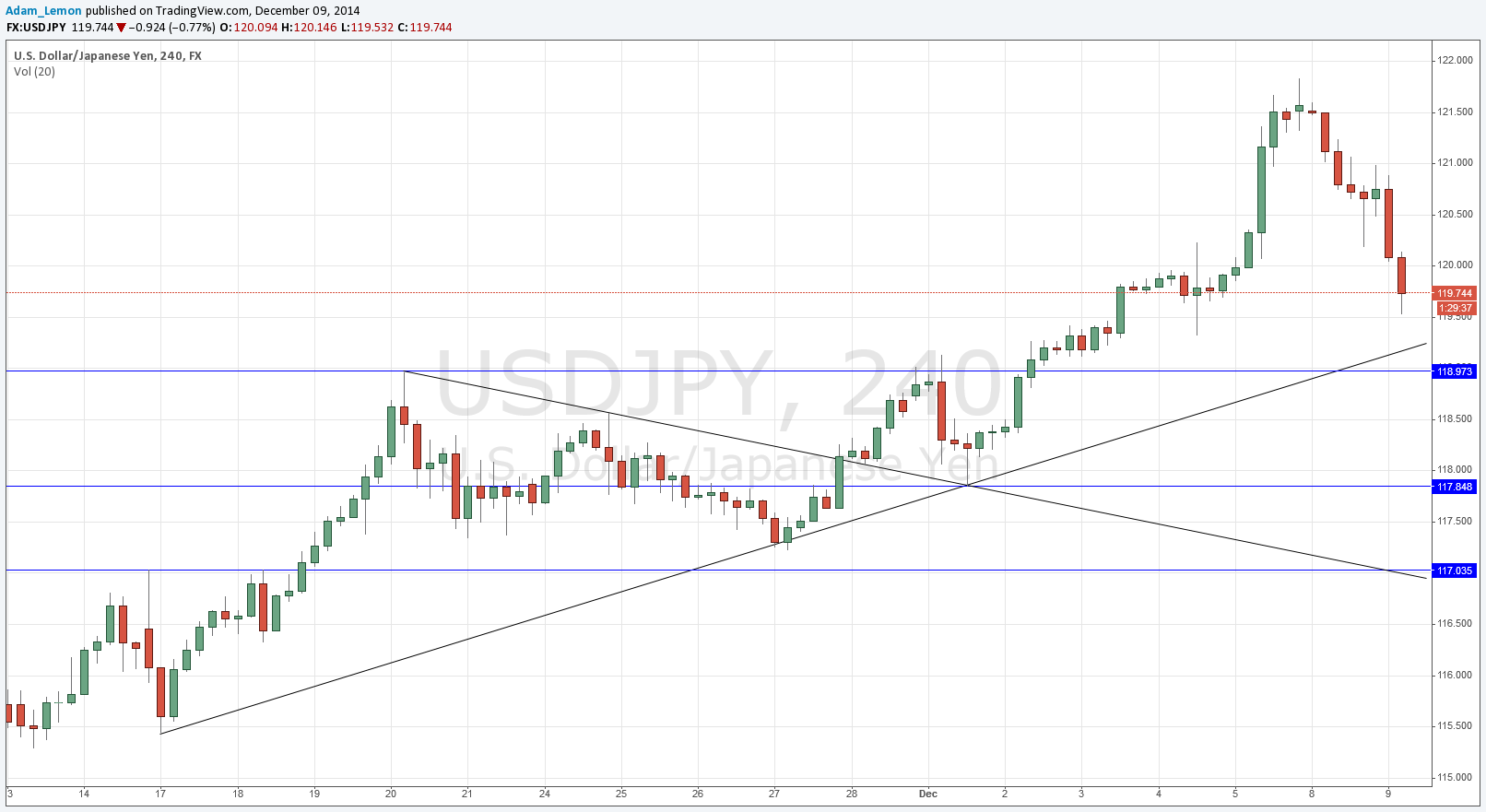

Long entry following bullish price action on the H1 time frame immediately after a retest of the bullish trend line below and the 119.00 level at the same time.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair was surprisingly active yesterday and has been falling hard. We fell through the support at around 120.00 quite easily and this is a bearish sign. Although this pair can turn very easily, when there has been so much bullish action over several weeks – and it has been very extreme – that there is bound to be at least one good bounce on the way down, and such bounces usually happen sooner rather than later.

We are now approaching another supportive area at around 119.00 and it is nearly confluent with the bullish trend line that has already had two touches. This will be a good area at which to look for a long opportunity, if supported by price action. My colleague Christopher Lewis is still looking to get long.

It is too early to say whether the trend is over but it has been several weeks since this pair has fallen this hard. Nevertheless, there has still been no break of a weekly low. There will probably be a lot of stops under the most recent weekly low placed by traders looking to protect their huge floating long position profits, so there might be a good short breakout trade if 117.85 is breached. That price is likely to be a pivotal point if and when it is reached.

There are no high-impact data releases scheduled today that will directly affect either the USD or the JPY.