USD/JPY Signal Update

Last Thursday’s signals expired without being triggered, as the price did not reach either 119.00 or 118.50.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm London time.

Long Trade 1

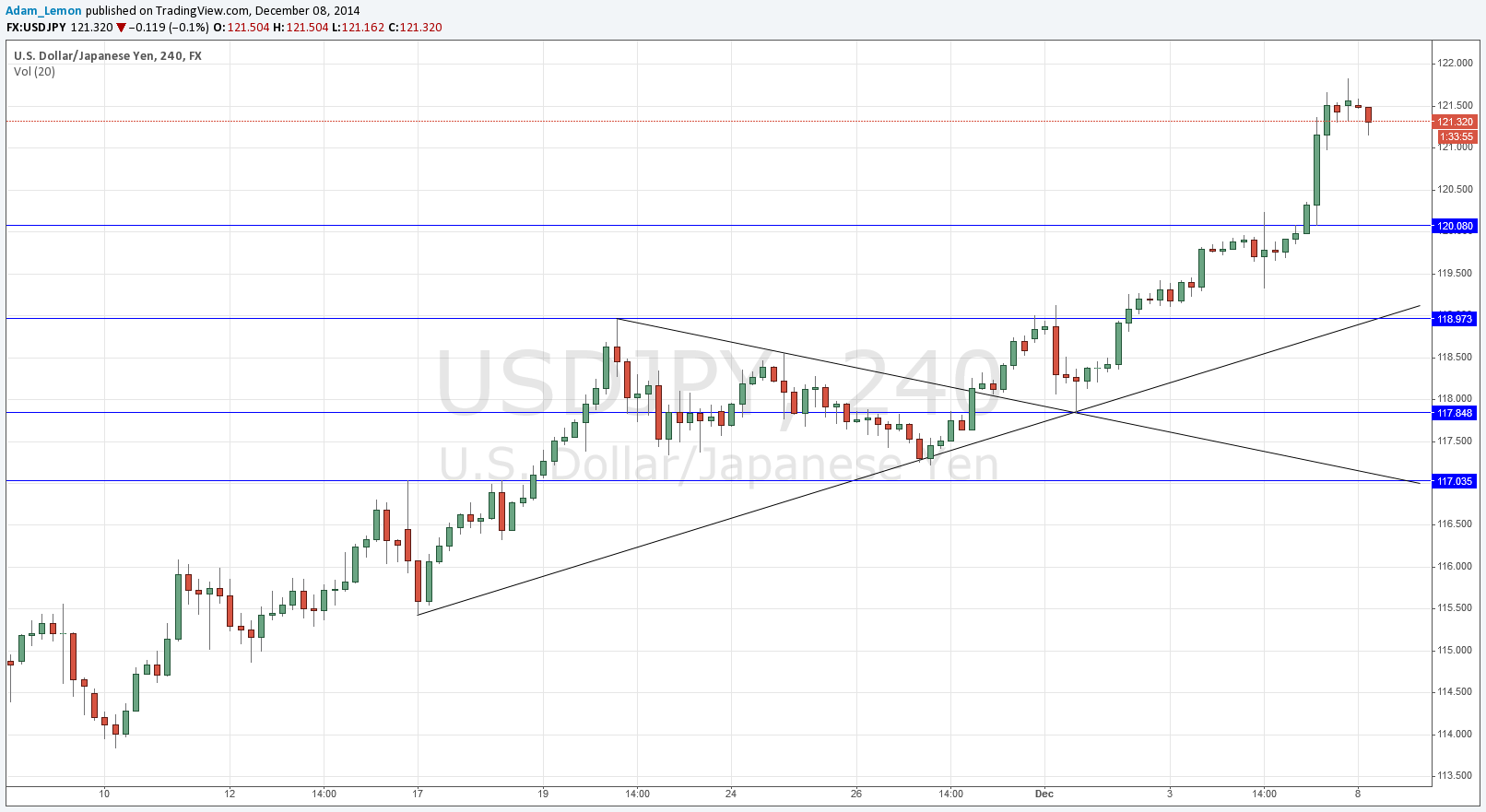

Go long following bullish price action on the H1 time frame immediately after a first touch of 120.08.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following bullish price action on the H1 time frame immediately after a retest of the bullish trend line below, currently sitting at about 119.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair just keeps going and going, just when it is tempting to think it cannot go any further. The key psychological number of 120.00 was broken quite easily and we are even well beyond that, past 121.00.

A lot at the weekly chart will show that every single week since about 1,500 pips below has made a higher low. This is an incredibly strong move that has shown no serious sign of slowing down, although the week before last was an inside week, which was a small hint that the trend might have been starting to run out of steam.

In these conditions one may profitably go long at any kind of reversal after a pull-back on the H4 chart. To be more cautious, wait for a return to likely demand zones at around 120.00 or even 119.00 if there is a more serious fall in the price.

There are no high-impact data releases scheduled today that will directly affect either the USD or the JPY. Therefore it is quite likely to be a relatively quiet day for this pair.