USD/JPY Signal Update

Yesterdays's signals were not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm London time.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately after a first touch of 119.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Long Trade 2

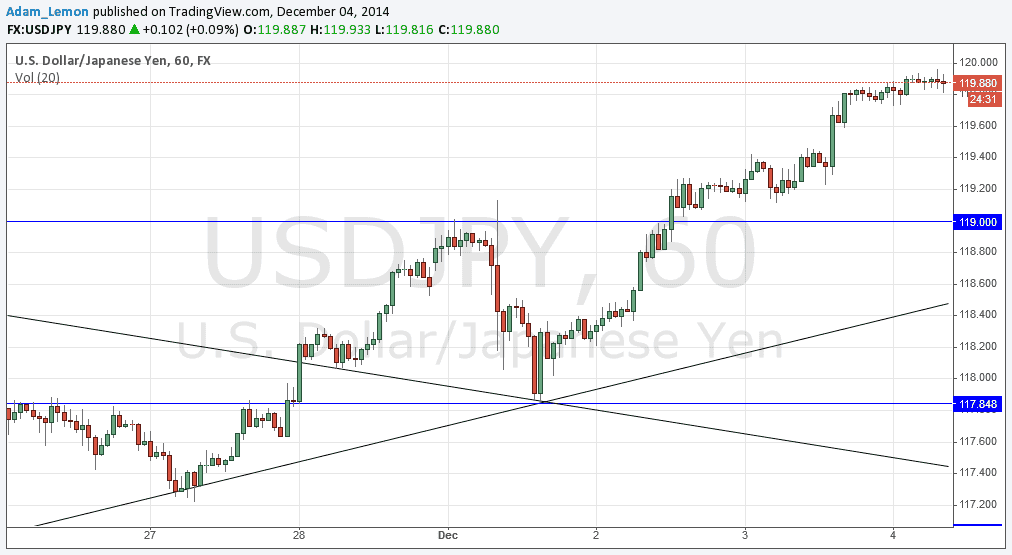

Long entry following bullish price action on the H1 time frame immediately after a retest of the bullish trend line below, currently sitting at about 118.50.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The strong bullishness has continued, and we almost hit 120.00 already this morning. There are really no good levels at which to look for short trades, although the heavy roundness of 120 might make this a natural area for profit taking, meaning we might not really break through it for a while.

Fortunately there are nnatural areas below us where resistance seems to have flipped to support, most notably at the round number of 119.00. There is also a bullish trend line below that, currently sitting at about 118.50.

There are no high-impact data releases scheduled today directly concerning the JPY. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm.