USD/JPY Signal Update

Yesterday’s signals were not triggered and expired.

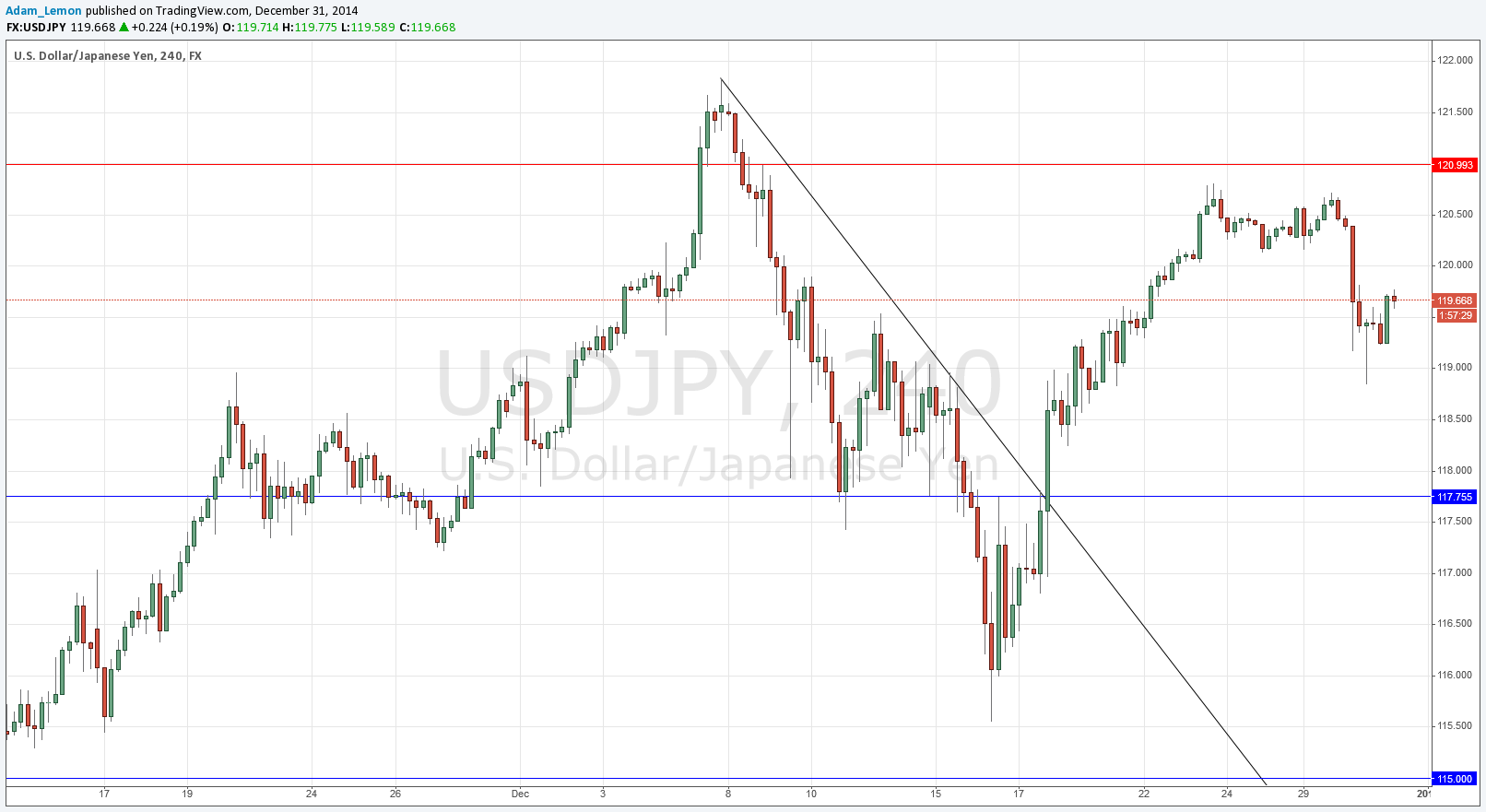

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only before 5pm New York time, and then after 8am Tokyo time.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately after the price first reaches 117.75.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately after the price first reaches 121.00.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair made a fairly strong drop yesterday, before recovering somewhat later.

It is too early to write off the upwards trend, but it is beginning to look like this pair is entering a phase of consolidation. However as the swings have been very strong, the initial waves of the consolidation are likely to produce quite a lot of directional pips.

Right now the pair is in no-man’s land, although there are weakly bullish signs.

There are no high-impact data releases scheduled today concerning the JPY, as it is a public holiday in Japan. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.