USD/JPY Signal Update

Yesterday's signal was not triggered because although the price did reach 117.85, the price action on the H1 chart was not sufficiently bullish at that level.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm New York time, or after 8am Tokyo time.

Long Trade 1

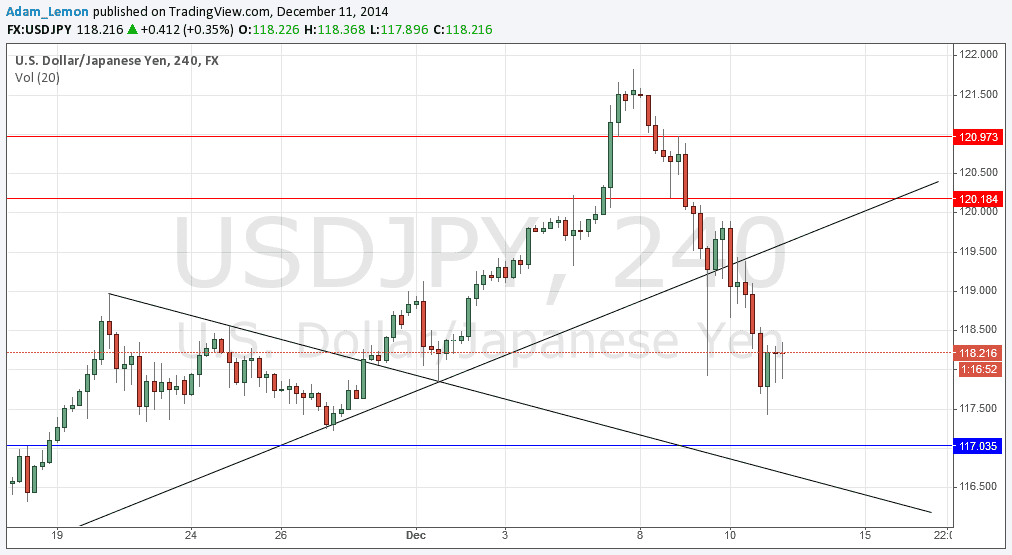

Long entry following bullish price action on the H1 time frame immediately after the price first reaches 117.04.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately after the price first reaches 120.19.

Place the stop loss 1 pip below the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following bearish price action on the H1 time frame immediately after the price first reaches 120.98.

Place the stop loss 1 pip below the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

Yesterday I wrote that the broken bullish trend line may become a launching pad for a bearish move, but that it was too early to tell. This was unfortunate as I should have been braver, because after meandering around the line on the H1 chart, it rejected the trend line bearishly right at the New York open, and this was the origin of another strong down move that finally took ut a previous week's low.

I was wrong in expecting a ranging period, we have had a continued downwards move. That is not to say the price won't start ranging soon.

Despite this we have found a little support this morning as the short stops probably gave liquidity to large players looking for another long, although we don't usually see the big move in this pair until around the time of the New York open.

There is more clear space on the chart now: we have two broken trend lines to watch that each may act as mobile support and resistance, as well as an old support level close to the round number at 117.00 and then new flipped resistance a little above 120.00.

There are no high-impact data releases scheduled today directly concerning the JPY. Regarding the USD, there will be releases of Retail Sales and Unemployment Claims data at 1:30pm.