Today’s USD/CAD Signals

Risk 0.75%

Trades must be entered before 5pm New York time.

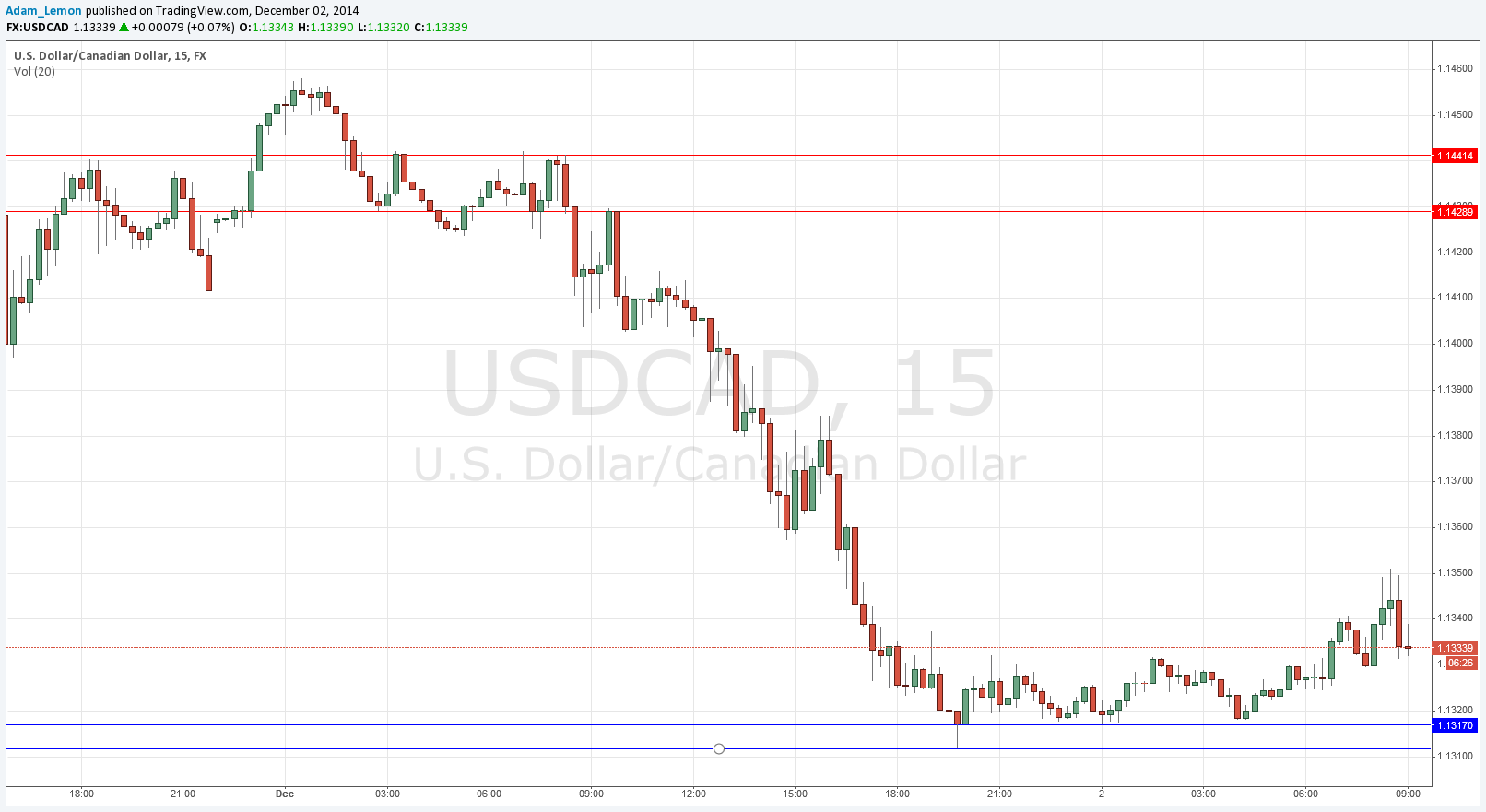

Short Trade 1

Short entry after bearish price action on the H1shorter time frames immediately following the entry into the 1.1428 – 1.1421 price zone.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry after bullish price action on the H1shorter time frames immediately following the entry into the 1.1317 – 1.1311 price zone.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

A long trade set-up is far more probable today, and should have a higher probability of success.

USD/CAD Analysis

This pair has a strong tendency to range and chop around. However, there has been a long-term upwards trend in this pair, driven partly by the strong USD, and partly by the weakening of the price of oil (CAD is highly correlated with oil, as Canada’s foreign revenues are heavily influenced by its sale of oil. The daily chart below shows two major trend lines that are both holding, and we are above recent flipped resistance to support levels. We are currently rising nicely and gradually off the support, which suggests the next swing will be upwards. A quick dip down to the support zone below could provide an excellent low risk, high reward long trade opportunity.

There are no high-impact data releases scheduled today that will directly affect either the USD or the CAD. Therefore it is likely to be a relatively quiet day for this pair.