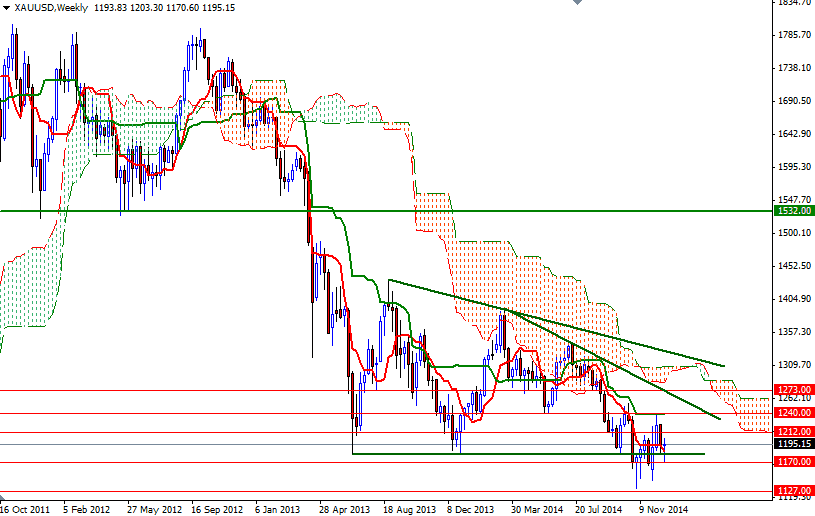

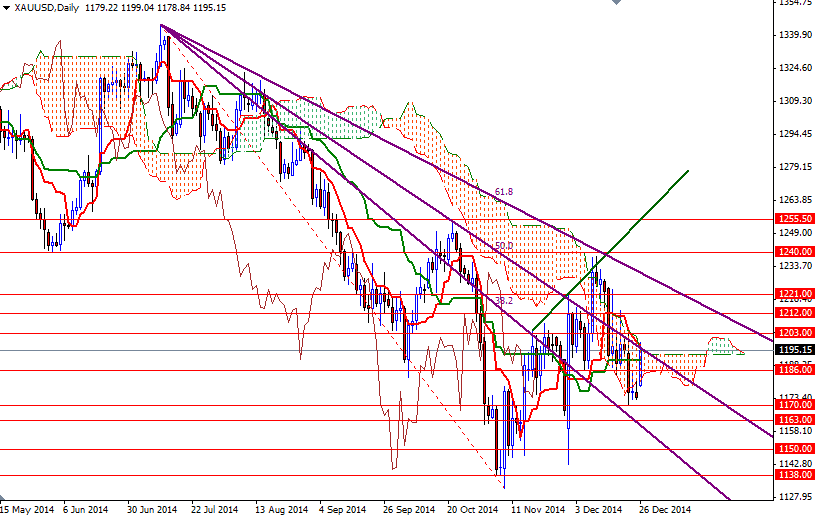

Gold had ended 2013 at $1206.80 per ounce and as you can see, today we are almost at the same level where we were one year ago. The precious metal initially tried to rally during 2014 as escalating tensions between Ukraine and Russia (and the sanctions imposed by the U.S. and EU.) pushed down stocks on major world markets and drove up buying of safe-haven assets but encountered massive resistance around the 1392 level where the Ichimoku cloud on the weekly chart resided. Since then we have witnessed some upward swings but in the end prices slumped to a four-and-a-half-year low in November as the greenback climbed and demand ebbed for an inflation hedge after crude oil tumbled.

On the other hand, the cheapest gold since 2010 unleashed a surge in demand for coins and small bars by retail investors around the world. Also some central banks increased the proportion of gold in their reserve assets. Very low prices raised concerns over supplies because the average cost of producing gold (for some of the world's biggest gold miners) was around $1100. Because of that, although I believe that the dollar rally has more room to run, I am a bit skeptical that we will see prices falling below $980 in the first quarter. However, I still don't expect a dazzling performance either, unless some sort of a serious financial/geopolitical instability threatens to drag stock markets around the world into a death spiral.

Gold rebounded nearly 6% since the market found support at 1131.96 but trading beneath the Ichimoku cloud on the weekly time frame suggests that there are tough barriers ahead. If the bulls manage to defend the support at 1163 and push prices beyond the 1121 level, it is likely that that the XAU/USD will test the critical 1235/40 area where the weekly Kijun-sen (twenty six-day moving average, green line) sits. Only a sustainable break above this area could give the bulls extra fuel they need to march towards the 1273 level. I will be looking for a top and signs of weakness around the 1287 - 1310 levels. To the down side, the key support to watch will be 1263/59 as shattering this floor would suggest that the bullish run will have to wait a little longer. If the bears capture this fort, I think they will have another chance to make assault on the 1131/27 zone. Once below that there is little to slow down the bears' progression until 1088/63.