The XAU/USD pair posted first weekly loss in three weeks as a strong rally in the U.S. dollar and waning inflationary pressure curbed demand for the precious metal. Gold traded as high as $1207.66 after hitting a 4½-year low earlier last month, partly because of renewed tension between Russia and the West and growing conviction that lower prices will have a negative impact on producers.

However, majority of trades have been avoiding long-term gold investments, as gains for the American economy have eroded the appeal of safe-haven assets. The gains in gold have been small so far and the bulls are still struggling to push the market higher. Lately, a series of mixed economic data out of the United States raised doubt over how quickly the Fed is going to start raising rates to normalize policy but the greenback will probably be the currency everybody wants to own because there is a divergence between the U.S. economy and other major economies in Asia and Europe.

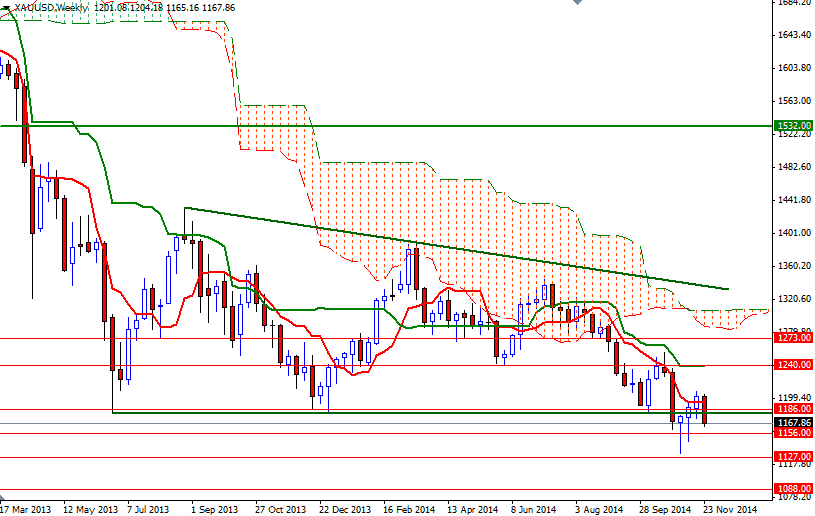

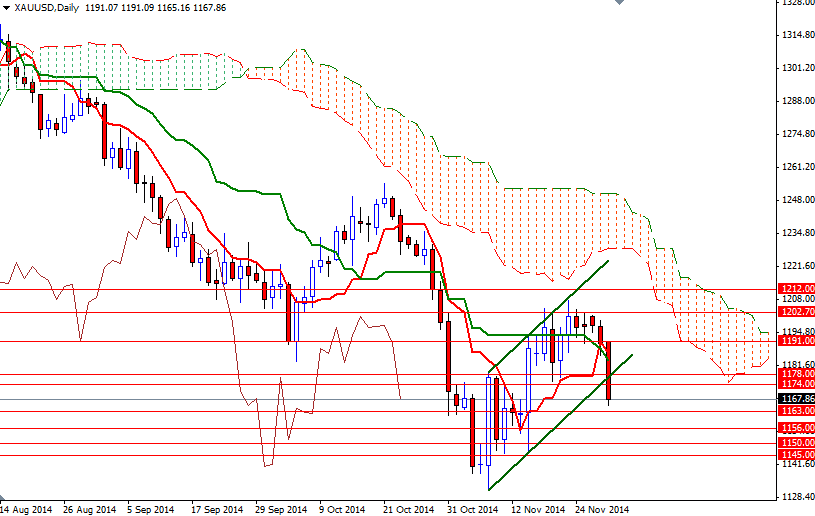

For the last couple of months, I have been repeating that the market won't have much room to the upside and rallies will be temporary, unless we anchor somewhere above the Ichimoku clouds on the daily chart. Until that day comes, I expect the market to maintain its negative bias - especially while beneath the 1186/0 region which had held the market up from June 2013 to the mid-October 2014. A break below the November 7 low of 1131 could puts us back on track with such a scenario eying subsequent targets at 1088 and 1062. To the upside, the first hurdle gold needs to jump is located in the 1202/12 area. Only a sustained break above this barrier might give the bulls a chance to march towards the 1240 level where the Kijun-Sen line (twenty six-day moving average, green line) currently resides on the weekly chart.