Last week, the biggest event for the market was the release of the U.S. jobs report. Gold prices fell sharply on the last trading day of the week after the Labor Department reported that the economy added 321000 jobs in November, far surpassing consensus estimates of 231000, and the unemployment rate held at a six-year low of 5.8%. Data also showed that gains for the prior month were revised up average hourly wages jumped 0.4%.

Not surprisingly, the stellar labor market data provided further evidence that the world's biggest economy is in a sustained recovery and boosted speculations that the Federal Reserve could begin raising interest rates in the middle of next year. Despite Friday's drop, the precious metal still managed to end the week 1.94% higher. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 89330 contracts, from 76207 a week earlier.

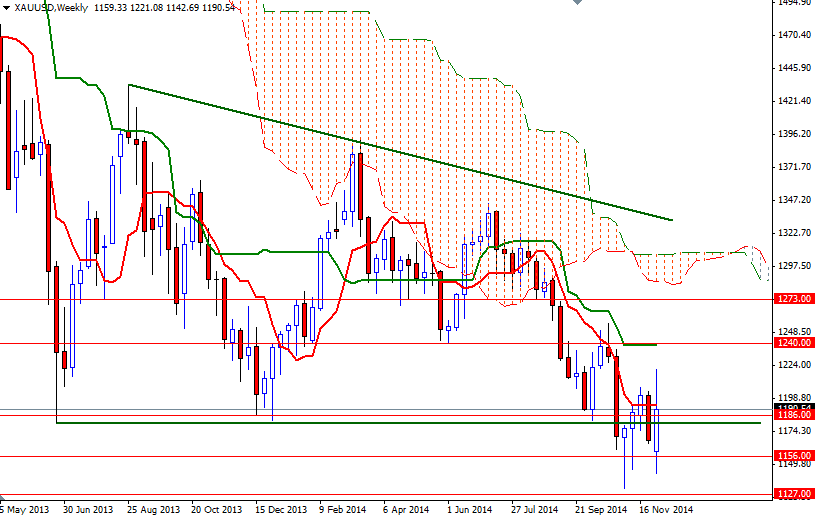

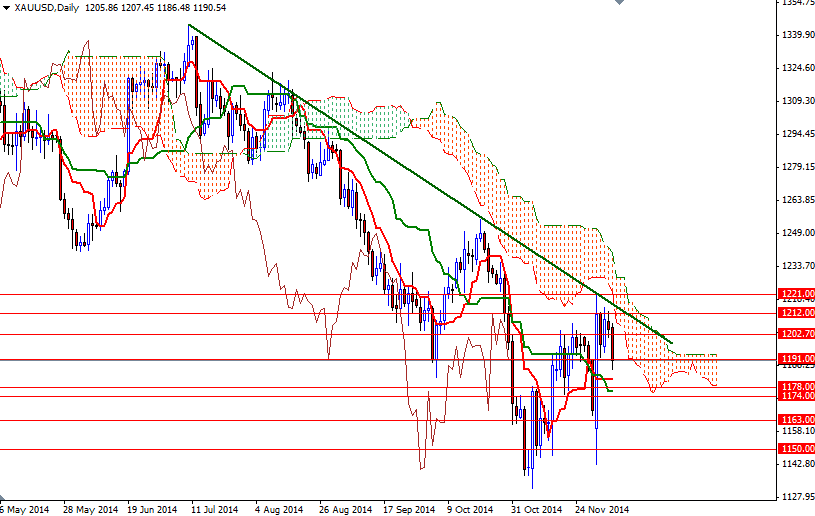

From a technical perspective, I think there are a couple of things to pay close attention. First of all, the XAU/USD pair run into a significant amount of resistance in the 1221/12 area as expected. In addition to that the Ichimoku clouds on the daily chart now coincides with the descending trend-line dating back to the July high of 1344.92. Because of that, the upside will be limited unless the market climbs and holds above the clouds. Only a close above 1221 could give the bulls the extra strength they need to start a journey towards the 1235/40 resistance zone. However, if the bears increase the downward pressure and gold prices drop below 1186, we could see the pair revisiting the supports at 1178 and 1174. A sustained break below this critical area would bring more sellers to the market and take us back to the 1163 level.