GBP/USD Signals Update

Yesterday’s signal to go long following a bullish bounce at 1.5650 was triggered and resulted in a losing trade.

Today’s GBP/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.5789.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

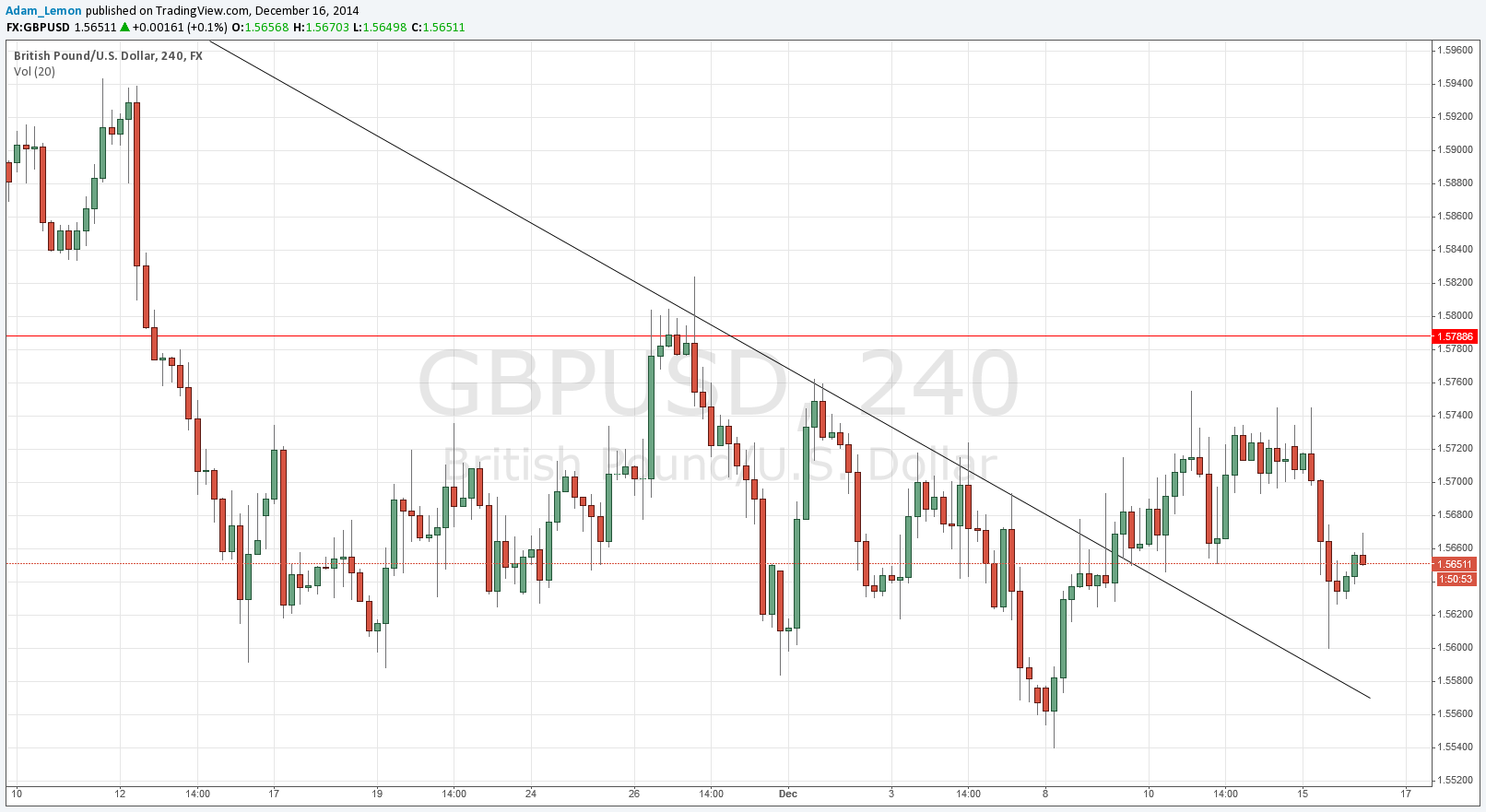

GBP/USD Analysis

The pair has been stuck in a fairly wide but aimless range for about one month now. This would normally indicate that a bottoming out is taking place, but local lows keep getting taken out. Although we broke up past a bearish trend line and retested it with another bounce, the price has almost fallen back to reach recent lows.

The result of all this is that it is very difficult to predict what this pair is going to do next.

It might be that we do get some support holding from around 1.5600. In any case, the resistance at 1.5789 will probably take more than one attempt to overcome, so there will probably be a potential short trade when we next reach that level.

There are high-impact data releases scheduled today directly concerning the GBP but nothing regarding the USD. At 7am London time there will be a release of U.K. Bank Stress Test Results. Then at 9am the Governor of the Bank of England will give a speech, followed by the release of CPI data half an hour later. The first half of the London session is likely to see most activity.