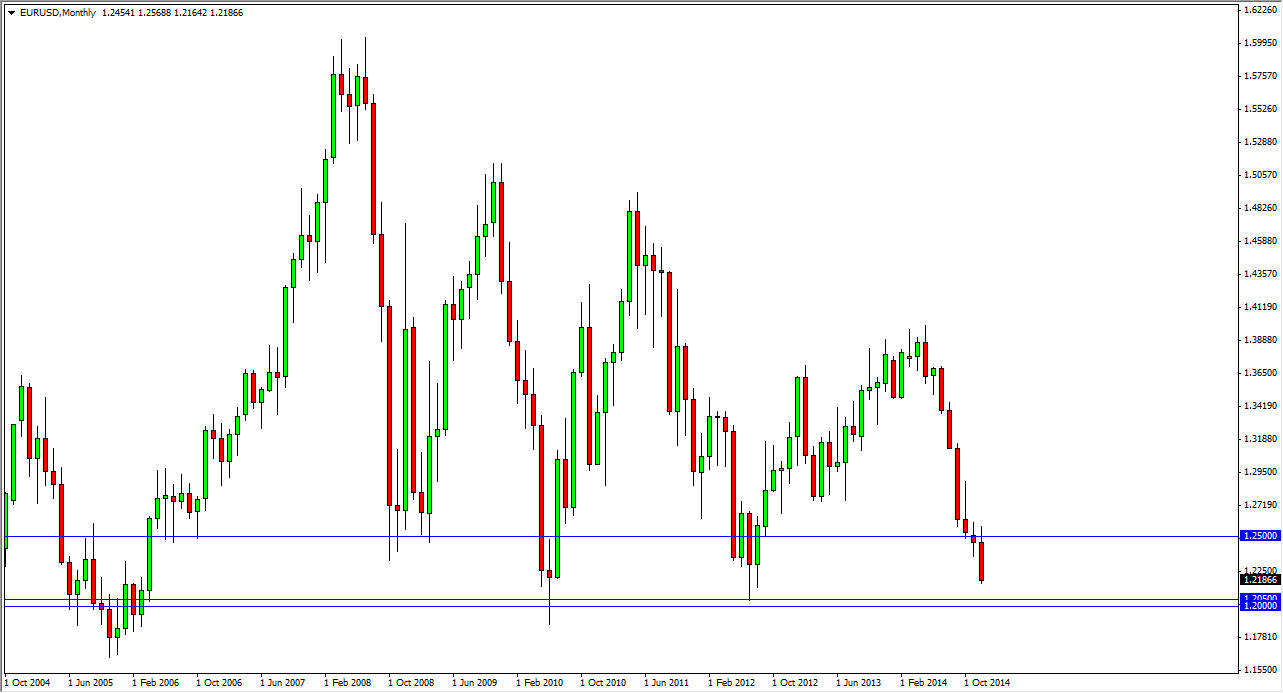

The EUR/USD pair initially tried to rally during the beginning of the month of December, but you can see that the 1.25 level offered enough resistance to turn the market back around. That being the case, we ended up falling from that area and crashing through the 1.22 level. As you can see on this monthly chart attached to this article I have a double line down at the 1.20 region. I believe that this market will fall back to that area to test support again, and I also believe that the market will bounce from there.

You can see that we have balanced from this area several times now, and ultimately we have always bounced. With that, the one thing that I would notice is that the bounce is lower and lower every time we do it. With that, I feel that we are going to repeat history, and although the European Central Bank has been shown to be very loose with its monetary policy, and should continue to be, I think that the selloff has been a bit overdone.

The Federal Reserve

The Federal Reserve has exited quantitative easing, and while that is a very strong sign for the US dollar, at the end of the day the market probably has overreacted as the Federal Reserve really isn’t that close to raising rates. I see the US dollar running into a bit of trouble just above on the US Dollar Index, which of course is very sensitive to this particular pair.

I think that the beginning of the quarter will be bearish as we have seen for some time, and then we will see a complete turnaround as often happens by the time we get to the bottom part of the January calendar. Ultimately, I feel that this market will bounce probably all the way back to the 1.30 handle or even higher than that given enough time. However, during the first quarter of 2015, I believe that the bearish movement will continue, followed by a significant bounce.