EUR/USD Signal Update

Last Thursday’s signals expired without being triggered. Although the price did reach both 1.2275 and 1.2417, the price action was not right to support either long or short trades.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm London time.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2400.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 1.2133.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run

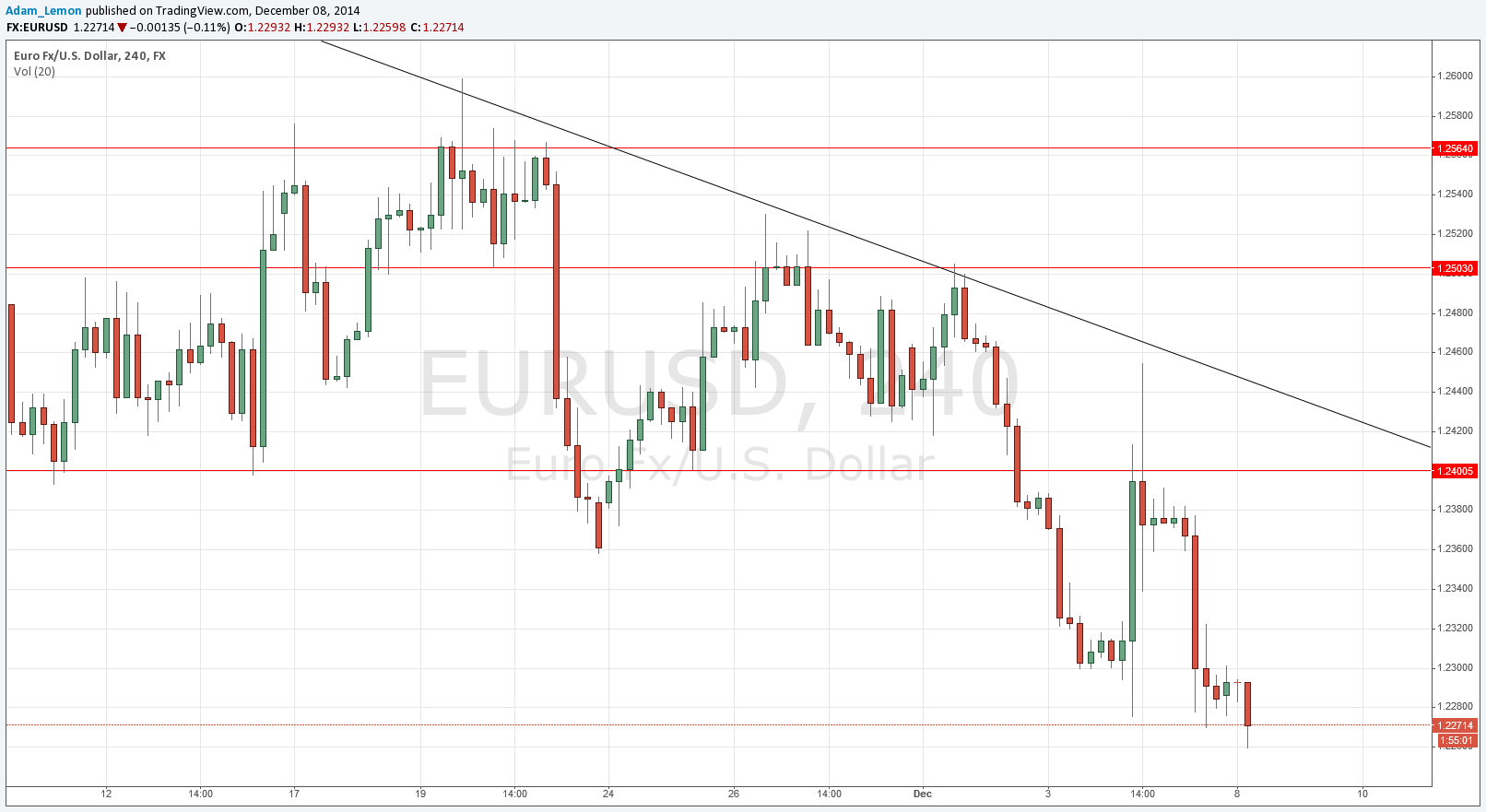

EUR/USD Analysis

The USD came roaring back at the end of last week, and all the major USD pairs made new long-term highs. The EUR is stronger than most other currencies, but still, this pair was no exception. A few minutes ago we broke the support at 1.2275 that I had thought might give us a launching pad for a small long move today, so that level seems to be muddied now.

I do not see any good levels at which to get short before 1.2400 or long before 1.2133, and as today is likely to be a quiet day, it will probably be one of the days where there are just no really good medium-term trading opportunities.

The overall picture looks bearish.

There are no high-impact data releases scheduled today directly concerning either the EUR or the USD. It is likely to be a quiet day for this pair.