EUR/USD Signal Update

Last Thursday’s signals expired without being triggered as the price did not reach either 1.2564 or 1.2442 during that day’s London session.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2503.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2564.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately following the next touch of 1.2355.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

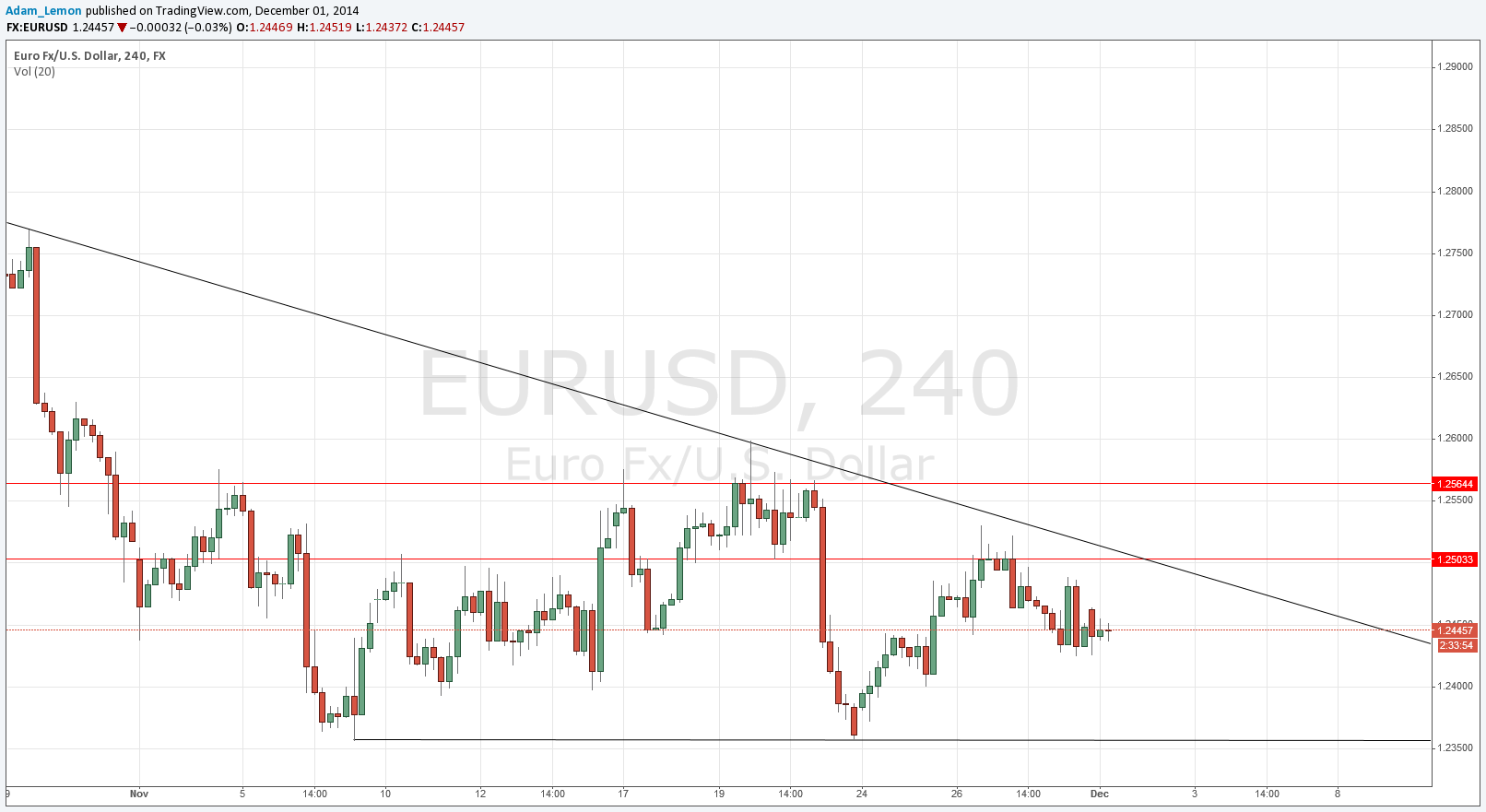

The bullishness ended abruptly last Thursday after the 1.2500 area acted as resistance in confluence with the bearish triangular trend line to push the price down again. This move down was not really able to get beyond the support 1.2442, although this support has now been muddied.

We are still within a triangle with a descending bearish trend line that has been forming over the past several weeks. That trend line is still confluent with the resistant area at around 1.2500. The interesting feature is the fairly widely spaced double bottom we have just above 1.2350. We should remember that we are approaching an area that has historically acted as long-term support for this pair, so if the downwards trend ends, maybe there will be a chance for a 2,000 pip long trade. That is something to keep in mind if you like trading long-term.

As long as the triangle lasts, we can fade both sides of it. A breakout of the triangle will be the next really key event for this pair, and a bullish breakout could be very significant, although there is a key hurdle at 1.2564 that would have to be overcome following the breakout.

There are no high-impact data releases scheduled today that will directly affect the EUR. Regarding the USD, at 3pm London time there will be a release of U.S. ISM Manufacturing PMI data. It is likely to be a relatively quiet day for this pair today.