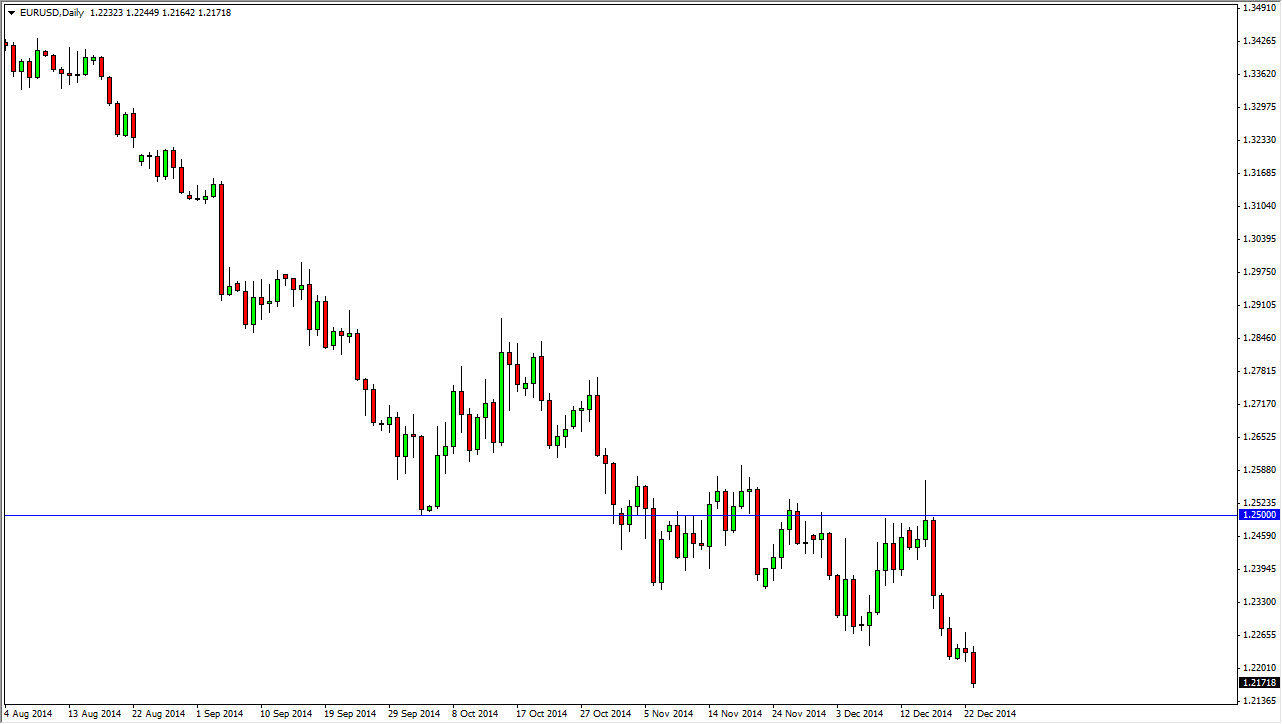

The EUR/USD pair fell during the course of the day on Tuesday as we broke below the 1.22 handle. This market looks as if it’s ready to continue to go lower and as a result I am a seller. I still believe that the market goes down to the 1.2050 level given enough time, and that rallies will be selling opportunities every time they happen. Looking at short-term charts will be the way to go going forward, especially considering that today is Christmas evening is going to be difficult to see a lot of liquidity in my opinion. Ultimately though, you simply cannot buy the Euro as it is essentially toxic at the moment.

However, I believe that there will be bounces from time to time, and there’s bounces of course will be value plays as far as the US dollar is concerned. Remember, the US dollar is the favored currency by Forex traders around the world, and as a result it’s only a matter of time before the flood money back into the United States. It has the strongest economy at the moment, and the Federal Reserve has stepped away from quantitative easing altogether.

European Central Bank

The ECB looks as if it has to continue the quantitative easing past, so it makes sense of the Euro would lose strength overall. With that, I think that the 1.2050 level is definitely a real possibility, and we could even go lower than that. The question then remains whether or not the Federal Reserve will raise interest rates anytime soon. I don’t think that’s going to be the case so a correction is almost certainly coming. I think somewhere near the 1.20 level we will start to see the first vestiges of a Euro rally. However, between now and the end of the year were probably not going to see anything along those lines, rather just an attempt to get down to that level. With that I am bearish but I recognize that looking at the longer-term charts is going to be very important as soon as we get into the month of January.