Gold prices fell slightly on Friday as investors cashed in recent gains after The University of Michigan's preliminary consumer confidence reading for December came in at 93.8, well above November's final reading of 88.8. The precious metal traded as low as $1214.31 an ounce after the release of the data but recovered some of the initial losses and settled at $1222.21. Gold ended the week up nearly 2.6% but gains are kept in check by expectations of tighter monetary policy in the United States. If market players start to believe that the Fed's new plan is to hike rates from rock-bottom lows, we may not see a long-term reversal anytime soon.

However, there is a link between equities markets and gold. If a major correction begins, investors might abandon stocks and flock to the safety of gold. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 114862 contracts (the highest level in sixteen weeks), from 89330 a week earlier. The major focus of the week will be on the Federal Reserve, which begins a two-day meeting on Tuesday. Fed policy makers insist that the outlook for interest rates depends on how economic data evolves and isn’t driven by the calendar.

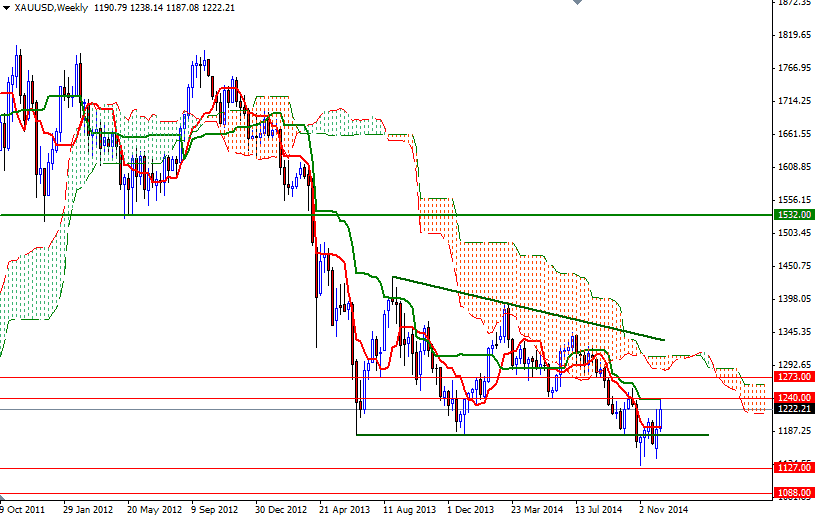

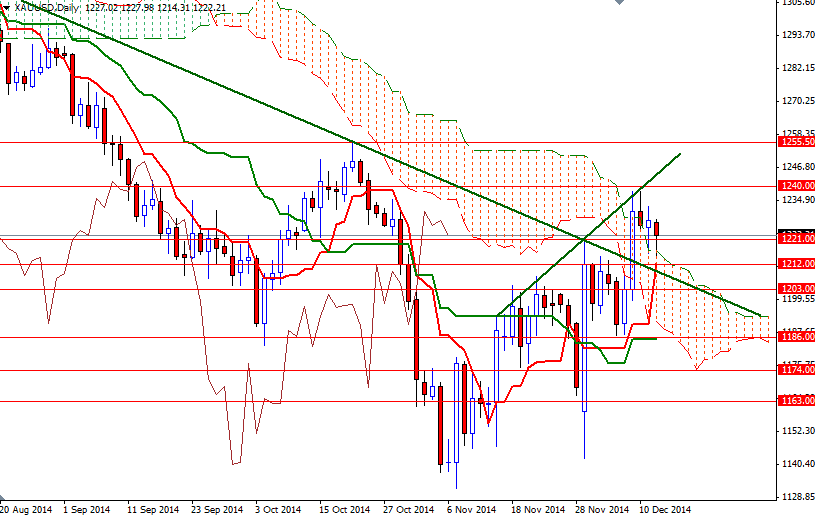

From a purely technical point of view, I am cautiously bullish on the XAU/USD while the market is holding above the Ichimoku clouds on the daily and 4-hour time frames. The Chikou-span (closing price plotted 26 periods behind, brown line) crossed above candles plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are positively aligned. On the other hand, the 1240 level has been an important battleground since mid-2013 and I still think that the bulls have to capture it so that they can approach the 1250/55 area. The Tenkan-sen only the daily chart currently sits at the 1212 level so that means the bears will need to push the market back below this support to gain some strength. In that case, I think the XAU/USD pair could revisit the 1203/1199 zone. Closing below the 1199 support on a daily basis would make me think that the bears are targeting the 1193 and 1186 levels.