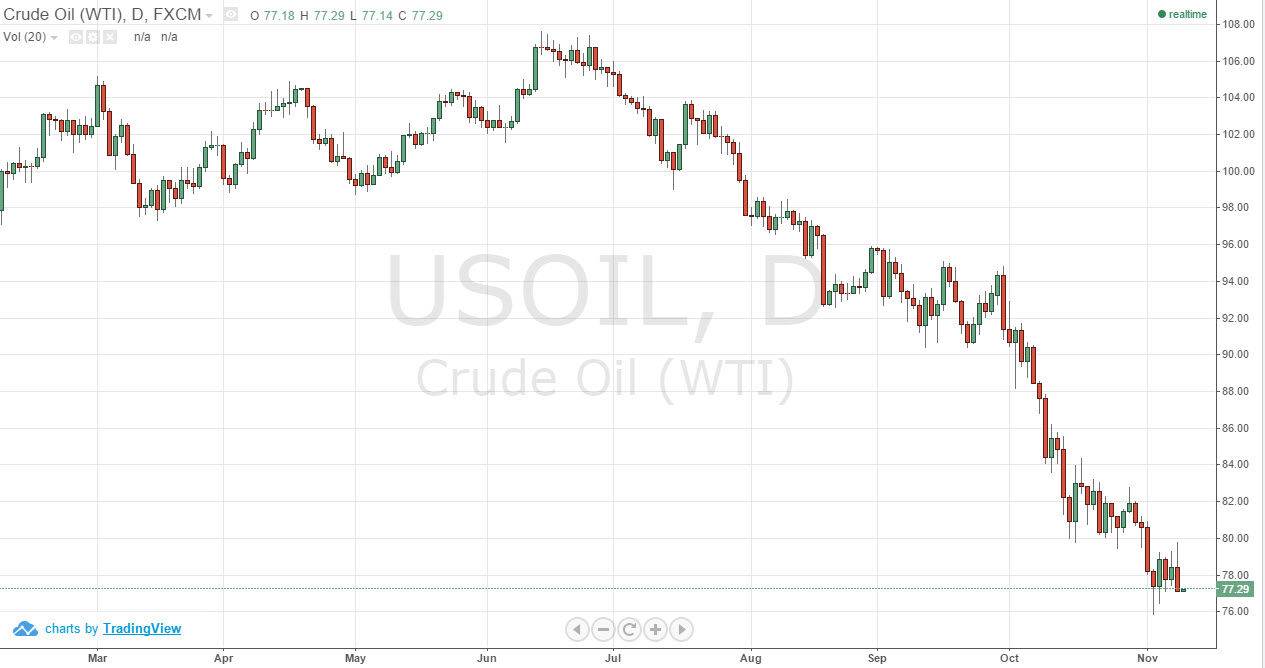

The WTI Crude Oil markets struggled yet again during the session on Monday, as we initially tried to break out to the upside and climb above the $80 handle. That area of course was previously support, so the fact that it offered resistance is in a big surprise, and only confirms that we are without a doubt in a very strong downtrend. We believe that the market should continue to fall from here, and recognize that the next round number is $75, and that should be the target that the market aims for over the longer term. As far as I can see, there’s no way to buy this market and that every time it rallies, it should be sold.

It really doesn’t matter what timeframe you choose to trade, because quite frankly I think that the downtrend that we have seen in this market is just simply far too strong to ignore. Yes, I recognize that we have fallen way too far in such a short amount of time, but ultimately there is a reason for this market falling apart, and because of that I believe that the bears will continue to punish this particular market.

Selling rallies, ignoring buy signals

Looking at this chart, I think that we will go to at least the aforementioned $75 handle, and probably lower than that given enough time. I also think that it’s almost impossible to buy this market as the massive amount of resistance near the $80 level extends all the way to at least the $82 handle, and that means that it’s going to be very difficult for this market to change its mind and more importantly, a trend.

There’s very little in the way of demand out there right now, and the fact that the US dollar continues to strengthen ways upon the value of this particular market as it certainly cannot continue to go higher. Ultimately, I believe that we will probably even break down below the $75 handle, and perhaps even go as low as $70. With that being the case, I will ignore any bullish signs.