By: Stephanie Brown

Amazon.com, Inc. (NASDAQ:AMZN) is gearing up for one of the fiercest rivalries in the video streaming business after announcing plans to launch an ad-supported video service. This will provide the giant e-commerce with an avenue to compete against Netflix, Inc. (NASDAQ:NFLX) for ad revenue, while additionally bolstering its market-share

This should complement the company’s existing $99 per year Prime membership video service and not replace it. The revelation comes only a few months after the Wall Street Journal reported that Amazon was indeed planning to launch a free ad-supported video service. Amazon vehemently rejected the report at the time.

Amazon currently offers video streaming service complete with a Free Episode feature that allows users to stream episodes of select TV shows as one of the ways of enticing consumers to purchase more. It already offers hundreds of TV shows, which are normally viewed on devices such as the Kindle Fire and Roku.

An ad-supported service should go a long way in allowing Amazon to immerse itself in the lucrative advertising business in which Google Inc. (NASDAQ:GOOGL) and Netflix have always acted as the dominant forces. This will provide Amazon more availability for its ads and enable the company to promote sales on a number of devices.

The video ad service will additionally give the company an opening to win over a portion of the population that has so far remained oblivious to the Prime membership scheme.

Amazon is innovating new initiatives as it looks to up its competition against Netflix. The company is slowly gaining ground with it currently the second largest paid streaming service in North America, which has more than doubled over the past 18 months.

Technical Analysis

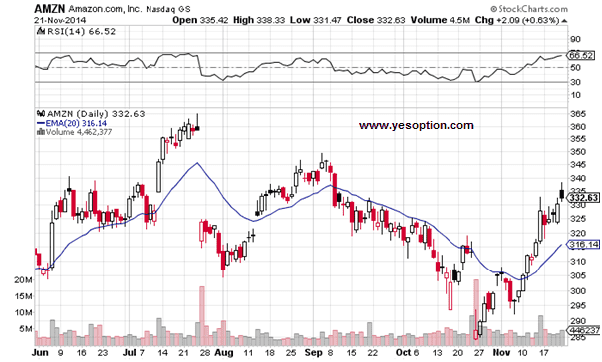

Amazon is continuing to move up, the stock forming higher-highs and higher-lows, which is of course a positive sign. Going forward the stock has strong support near$315 and $320, whereas resistance is near $338 and $344 on the upside. Momentum indicators like the RSI took a pause in Friday’s trading session but overall it is rising.

Actionable Insight:

Buy Amazon.com, Inc. (NASDAQ:AMZN) above $335 for target of $339, $345, with a stop-loss of $332.5