USD/JPY Signal Update

Yesterday’s signal was not triggered and expired, as the price never hit 117.03.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be entered between 8am London time and 1pm New York time; and then after 8am Tokyo time.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately following the next touch of 117.03.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately following the next touch of the descending trend line.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

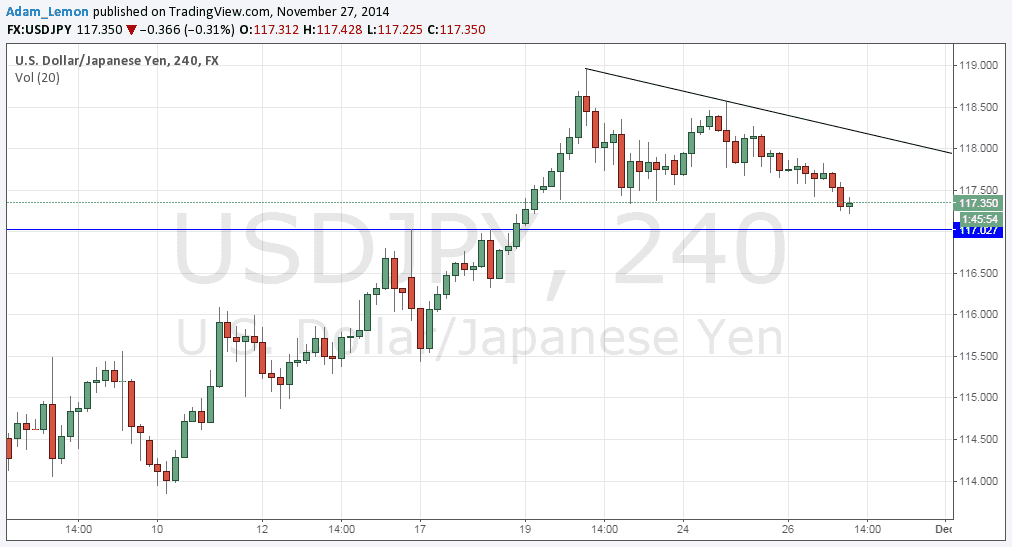

This pair has moved well away from being the centre of the Forex market, continuing to break down slowly yesterday but not quite reaching 117.03. At this level there is a confluence of a previously resistant double top and a round number, so it is likely there will be some support there. Whether this will be significant enough to push the price up by much, is hard to tell.

Above there is a well-established descending bearish trend line, and a rejection of this could be a good area at which to enter a short trade. This could become safer if we reach 117.03 first and nothing dramatically bullish happens.

There are no high-impact data releases scheduled today that will directly affect either the USD or the JPY. It is a public holiday in the USA. It is likely to be a quiet day for this pair today, especially during the second half of the London session.