By: YesOption

Netflix, Inc. (NASDAQ:NFLX) continues to face challenges in the video-streaming business as completion continues to increase. Right after announcing that it plans to expand into Australia, came an onslaught of local TV providers proclaiming that they too are seeking the same market-share.

Netflix should be prepared to face its biggest test in Australia as partnerships in the video-streaming industry continue to take shape. Foxtel already reduced its monthly subscription fee to $25 as it seeks to attract more subscribers, as well as fending off competition from Netflix. Furthermore, a joint partnership between Nine and Fairfax is additionally taking shape. Stan, another provider though, is expected to be Netflix’s biggest threat as it plans to launch a simple monthly plan of approximately $10. Stan also stated that subscribers can stream all the movies and TV shows they want from its service. Netflix however, counters that it can enjoy success in Australia, as it already has some 200,000-plus subscribers

Providing quality content will be the biggest hurdle for Stan if it wants to attract as many subscribers as possible, while fending off incoming competition. It is looking to differentiate itself from Netflix by providing a library that is far diverse and unique in content. Stan already confirmed that it has received rights for Breaking Bad, as well as exclusive rights for upcoming spinoff series Better Call Saul. Netflix, may in fact struggle in Australia as its library is far more limited compared to Spotify, which is known to offer subscribers one of the biggest content libraries.

Netflix on the other hand, may increase their overall market share is after carefully upgrading its kid-content section. Additionally, the network additionally launched a ‘kids-content-only’ logins for users.

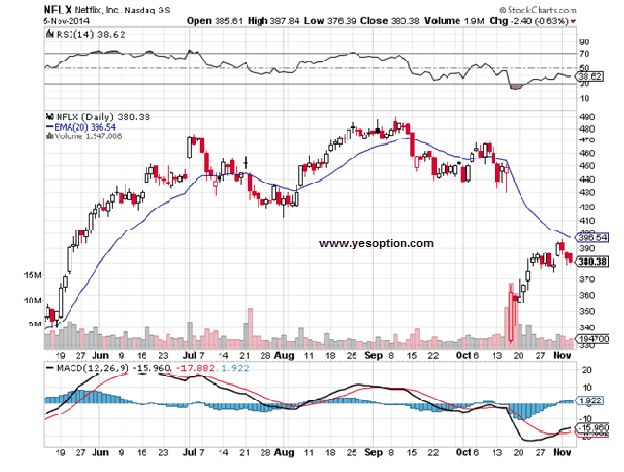

Technical Analysis

Netflix Inc. (NASDAQ:NFLX) has been trading substantially lower over the last three trading sessions. The stock after opening at $385.61 could not sustain itself at higher levels and closed at $380.38 (-0.63%). Netflix, is currently trading below its 20-Day EMA of $396.54, which analysts feel is a negative sign.

It corrected itself by $100 after a disappointing set of numbers which saw its number of subscribers dwindle. Going forward the stock will need a real boost in order for it to move up considering overall sentiment is quite bearish. Lastly traders should closely watch levels of $350-$360 for bottom fishing.

Actionable Insight

Sell Netflix, Inc. (NASDAQ:NFLX) below $377.5 for target of $372, $367, with stop-loss of $380