By: Yesoption

LinkedIn Corp (NYSE:LNKD), which very recently released a stellar earnings report is now high on many analysts radar. The social media giant, which calls itself a professional network may receive less press compared to its rivals, Facebook and Twitter, but is performing smartly and taking advantage of ample growth opportunities.

LinkedIn is one of the few staunch overachievers in the social media market thanks in-part to a rather bullish management chain. Its excellent Q3 results have led investors to believe that the stock can reach an even loftier standing.

It is imperative to note that LinkedIn beat almost all analyst estimates both on the top and bottom lines. Over the past few months, the corporation, along with other social media giants employed multitudes of data scientists. These individuals provide insight into consumer patterns of usage, thereby helping companies like LinkedIn enable its advertisers to customise adds to the people who they feel will most likely be interested.

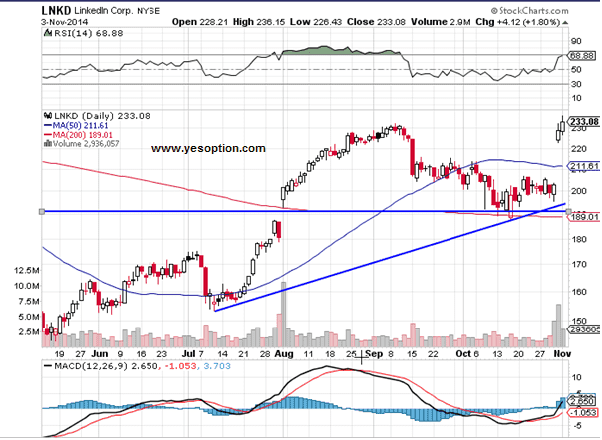

When looking at the daily chart for LinkedIn, the stock is currently trading in a very narrow range between its daily moving averages. It is additionally forming very good support around its 200-day moving average of $189 while finding resistance at $211, which happens to be the 50-day moving average for the stock. Its momentum indicator is giving a fresh buy signal, implying a push towards the buy side. Lastly, the relative strength index is additionally in bullish territory and shows no sign of reversing any time soon.

Actionable Insight:

Long LinkedIn Corp (NYSE:LNKD) at current levels for a short-term target at $211, with a strict stop loss below $197

Short LinkedIn Corp (NYSE:LNKD) if it closes below $189 for an intermediate target at $177