Gold prices closed lower on Monday, giving back a portion of the previous week’s gains as the bulls continued to encounter resistance around the $1203 level. Richard Fisher's comments about inflation and bullish sentiment in equities also weighed on the market. Richard Fisher, the president of the Federal Reserve Bank of Dallas, said "I don’t see inflation risks right now. I can see us lifting up gradually to the 2% target...A little bit below doesn’t bother me, particularly if it’s supply driven".

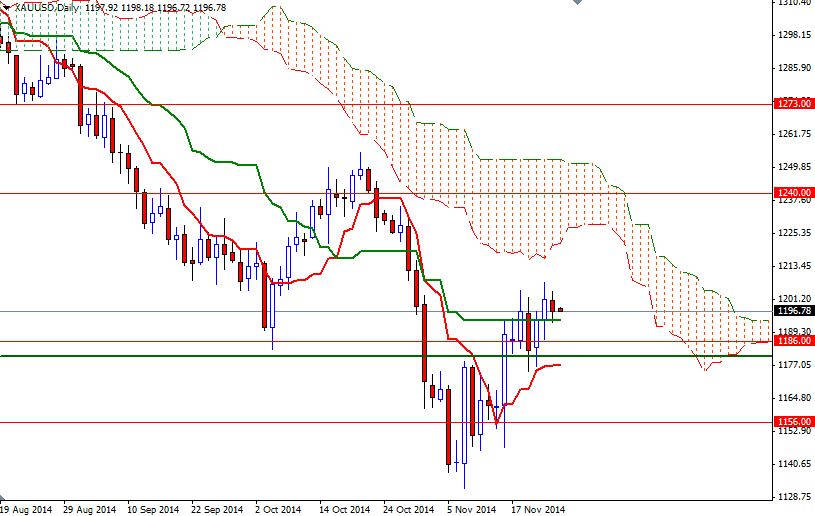

Lately the precious metal found some support due to physical demand, which has picked up in response to the lowest prices in more than four years, but growing conviction that the dollar is likely to strengthen is limiting the upside. From a purely technical standpoint, I think the general outlook will remain bearish as long as the XAU/USD pair trades below the Ichimoku clouds on the daily and weekly time frames. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself.

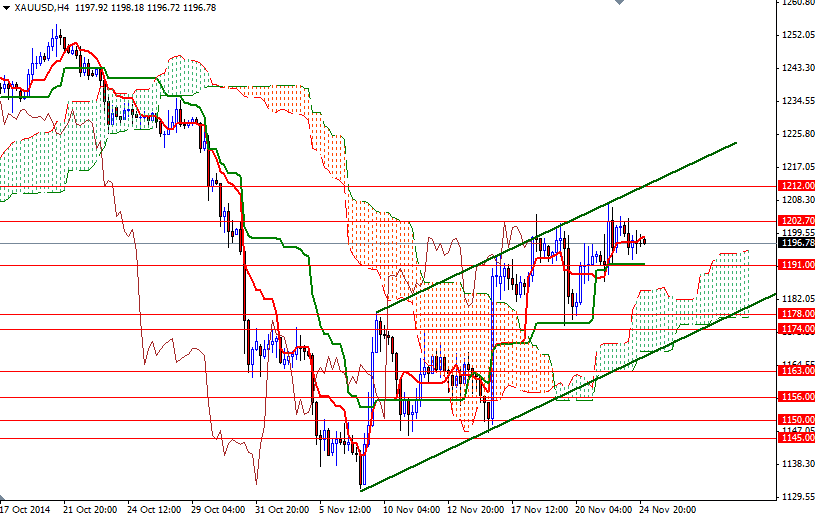

However, the 4-hour chart is still slightly positive, indicating that the bulls haven't run out of gas yet. Yesterday's candle was an inside day and the market is trading in a relatively tight range during the Asian session today so I will keep an eye on the 1203 and 1191 levels. It is quite possible that the XAU/USD pair will continue to grind higher if the 1203 resistance is broken. In that case, I think the bulls will be targeting the next barrier at the 1212 level. Only a daily close beyond that level could give the bulls some extra fuel they need to test the 1222 resistance level. If the bears take the reins and drag the market below 1191, we may see prices heading back to the could (4-hour chart). On its way down, support can be found at 1186 and 1178/4. Once below 1174, I think the 1163 support level will be the next.