Gold prices closed lower on Wednesday, erasing all of the previous day's gains, after the minutes from the Federal Open Market Committee’s October 28-29 meeting showed that policy makers are concerned about the inflation outlook. Inflation has been low relative to the FOMC’s target and recent slump in oil prices is adding to downward pressure. According to the records, “Many participants observed the committee should remain attentive to evidence of a possible downward shift in longer-term inflation expectations”.

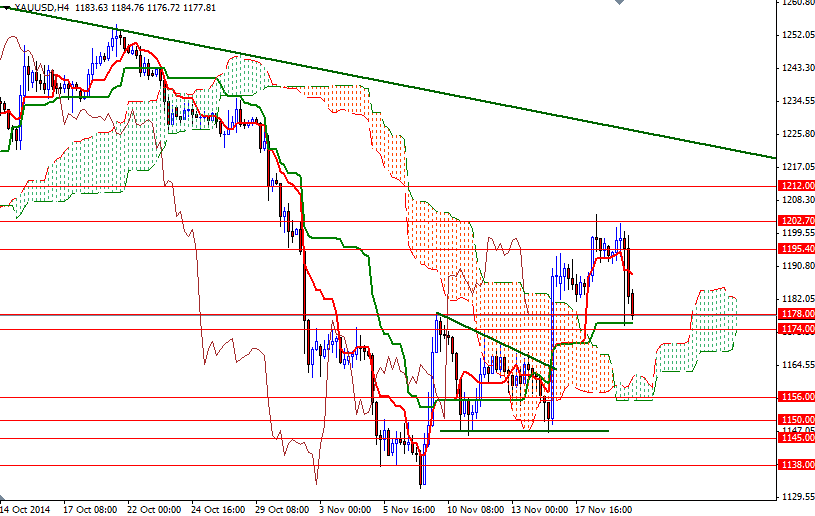

Although minutes provided little insight into when interest rates could rise, weakened demand dragged the market back to the $1178/4 region where the Kijun-sen line (twenty six-day moving average, green line) sits on the 4-hour time frame. As I mentioned in my previous analysis, breaching this support is essential if the bears intend to make a fresh assault on 1162. Closing back below the Ichimoku cloud (4-hour chart) would suggest that the XAU/USD pair will head towards 1156 next.

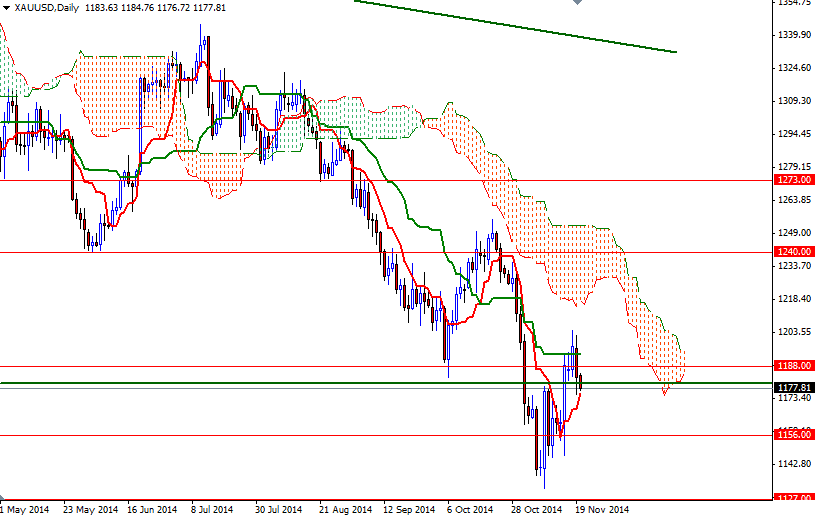

To the upside, there are still strong barriers ahead and unless the bulls pushes prices above the Ichimoku cloud on the daily time frame, dominant downtrend will remain in focus. The first hurdle gold needs to jump is located around the 1190 level. Beyond that, expect to see resistance at 1195.40 and 1202.70. Only a break above this resistance could give the bulls the extra power they need to reach the 1222/5 zone.