GBP/USD Signals Update

Yesterday’s signal expired without being triggered as the price never hit 1.5750.

Today’s GBP/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time.

Short Trade

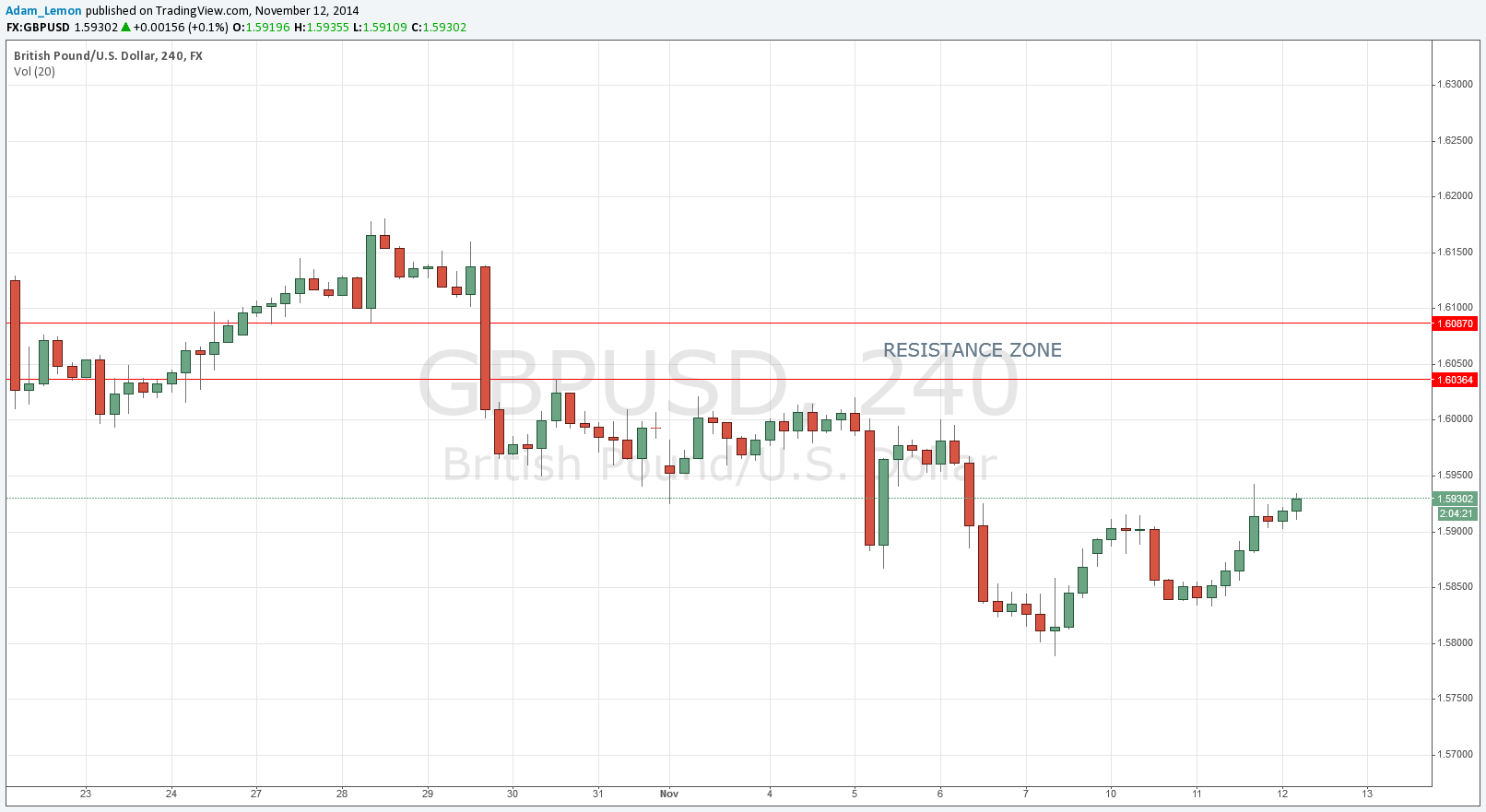

Go short following bearish price action on the 1H1 time frame once the price has entered into the resistance zone between 1.6036 and 1.6087.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

The pair has begun moving up but is still some way from the beginning of likely resistance at around 1.6025. There is lots of GBP high-impact news due during the first half of today’s London session, so this might well spike the price up into the area between 1.6036 and 1.6087, which is likely to be resistant. This would offer a good short opportunity, particularly if there is GBP bullish impact followed in the second round of news by GBP bearish impact. There is no news due today for the USD which helps.

There is a very small chance the news could spike the price down to 1.5750, which could be a good level to set a limit buy order at.

There are no high-impact news releases scheduled today that are likely to affect the USD. Regarding the GBP, there will be releases of Average Earnings Index and Claimant Count Change data at 9:30am London time, followed by a Speech by the Governor of the Bank of England and the Inflation Report at 10:30. The U.S.A. returns after yesterday’s public holiday so volatility will probably pick up today. It is likely that the early part of the London session is going to be very volatile.