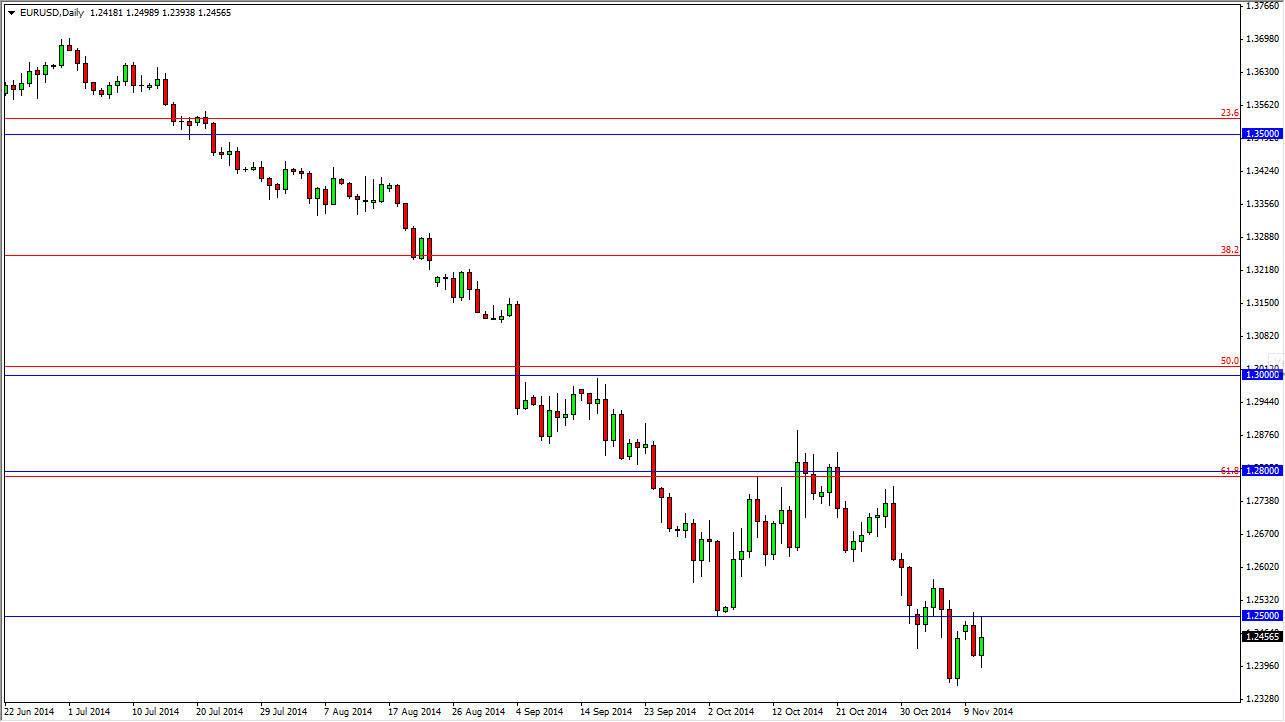

The EUR/USD pair tried to rally during the course of the day on Tuesday, and although we did keep some of the gains, the most telling thing about this candle in my opinion is the fact that we struggled so hard at the 1.25 handle. We pullback in order to form a shooting star which of course is bearish, and the trend of course would suggest that should be the way to be trading also. With that being the case, I feel that the market should go much lower, and as a result I am very interested in selling this market again and again. I look to short-term charts for trading opportunities as I believe this will continue to be one of those situations where we get more and more opportunities.

Looking forward, I believe that the European Central Bank will continue to have a jawbone the value of the Euro down, and probably loosen monetary policy as well. On the other side of the Atlantic, you have the Federal Reserve which of course has left the quantitative easing game altogether. In other words, people were going to favor the US dollar overall.

Round-trip

I also believe that this market is about to make a so-called “round-trip”, and other words going back to the beginning of the uptrend that we have just destroyed. That sends this market following down to the 1.2050 level, which is much lower than the area here. That doesn’t mean that the market is going to get down there right away, and because of that I believe that this will be a choppy affair. However, I do believe that the writing is on the wall, and then eventually this trend will send the market down to that area.

I don’t like buying this pair at all, at least until we get above the 1.30 handle. I think the 1.25 level will continue to offer resistance, and there is a lot of noise between Darren the 1.28 handle. I think that the 1.28 handle above is massively resistive, and probably extends all the way to the 1.30 handle. Because of that, it’s just going to be easier to sell rallies as they fail.