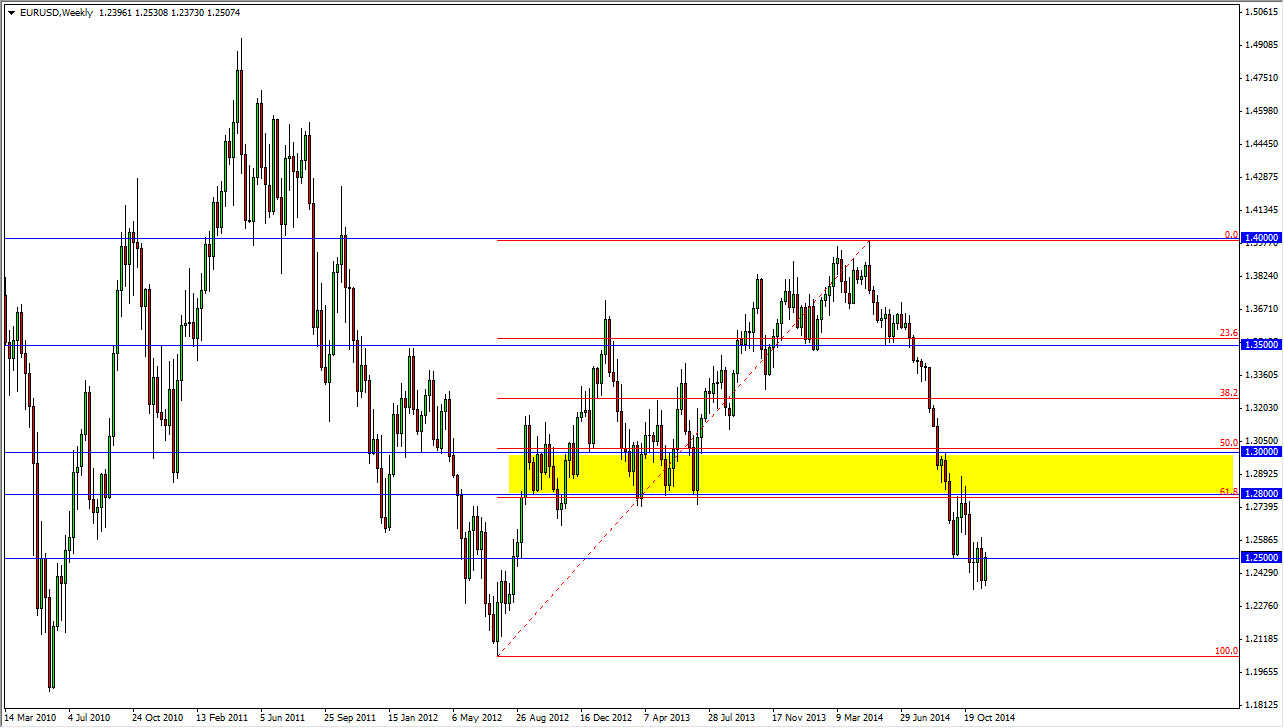

The EUR/USD pair has been in a massive downtrend for some time. However, during the entirety of November, we have seen quite a bit of consolidation near the 1.25 handle. I think that the market is probably due for a bounce at this point, and as you see on the chart I have highlighted the region between the 1.28 and 1.30 handles. This is an area that I believe has a massive amount of resistance built up into it, so it’s not out of the question for the market to reach back there and try that area for selling pressure.

As you read my December forecasts, you will see that I keep mentioning the fact that money managers are going to be taking money out of the marketplace and returning it to their clients. If you have been a money manager making money selling this pair for months now, you have hefty profits built up. Because of this, you will more than likely reverse those positions in order to collect those profits, and give a good return to your clients so that they continue to invest in your fund.

Repatriation

Let us not forget that various international firms will be repatriating currency from around the world. This is without a doubt the most fluid and largest currency pair that you will ever come across, so this is the one that tends to move the most during December, especially in the back half of the month as liquidity is almost nil.

With that, I believe that looking for resistance somewhere just below the 1.30 handle will be an excellent selling opportunity going forward. On the other hand, if we broke down below the 1.24 handle, at that point in time I would have to believe that we are going to make it down to the 1.2050 level rather quickly. The way that this market has been acting over the last couple months though tells me that the sellers are running out of strength, and that this bounce that I anticipate would not only be expected, but quite healthy in the larger scheme of things.