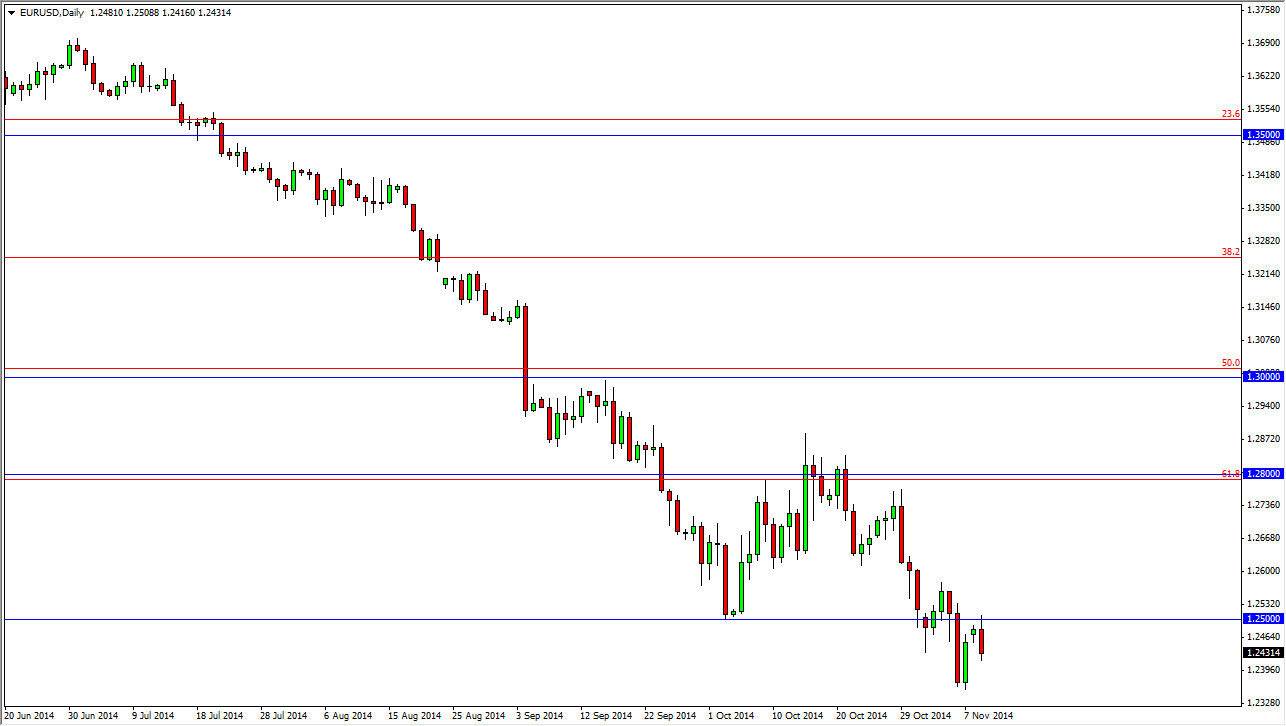

The EUR/USD pair initially tried to rally during the session on Monday, but found the 1.25 level be far too resistive to continue going higher. Because of this, the market ended up forming a fairly bearish candle as we fell, showing that the market will more than likely continue in the downtrend that we have been stuck in for quite some time. As you know, I have been saying for some time that you should sell all of the rallies that you see in this market, and the Monday session was a perfect example of that.

I believe that this market is going to essentially do a “round-trip”, meaning that we are going to go back down to the point at which we started the uptrend that is now so destroyed. That means we can go as low as 1.2050 over the longer term, and therefore I will continue to sell rallies as they appear. Don’t get me wrong, I think you can do this from a longer-term perspective as well, but the Euro tends to have its fans no matter what’s going on, so this is not a market that like selling off the Euro side of it given the opportunity to go against that. However, without a doubt I believe that the US dollar will continue to strengthen based upon central bank expectations.

Divergence of plans

There is definitely a divergence of plans as far central banks are concerned. The Federal Reserve of course is getting out of the quantitative easing game, while the European Central Bank will have to continue stepping on the accelerator as Europe continues to have so many problems. Ultimately, I think that this market will continue to punish the ECB because of that, but it might be a bit of an orderly fall, so I’m not looking for this market to fall apart suddenly. I think it takes a while to get down to the aforementioned 1.2050 target, so I think this will continue to offer selling opportunities again and again. There is no scenario in which I’m willing to buy this market.