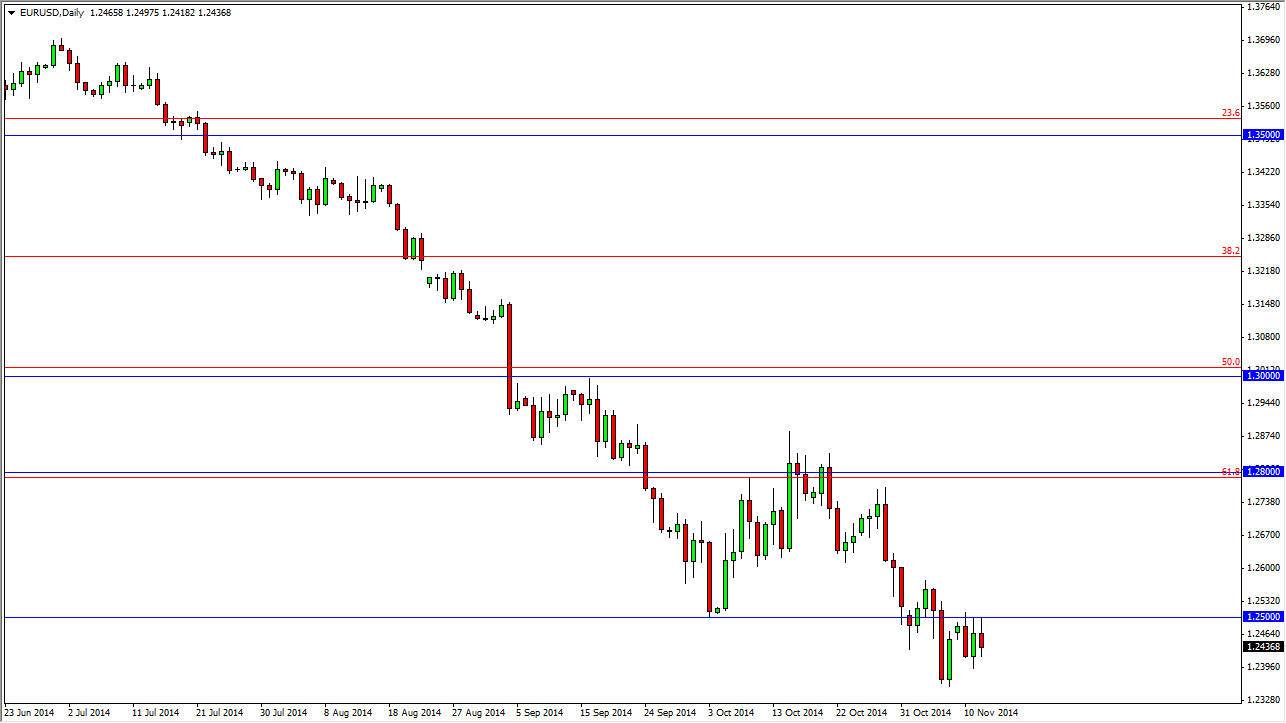

The EUR/USD pair continues to fail out the 1.25 level, and the Wednesday session of course was no different. With that being the case, the market looks as if it’s ready to continue falling, as the market is most certainly in a fairly negative downtrend. We have seen this market bounce off of the 1.25 level for three days in a row now, and as a result I think it’s only a matter of time before we continue to drop again. With that being said, I’m still selling this market on short-term rallies.

I have no interest in buying this market, because I see so much in the way of resistance above. I think that the 1.25 level is obviously resistance, but I also think that there is a massive amount resistance between the 1.28 and the 1.30 handles. Between 1.25 and 1.28, I anticipate seeing quite a bit of noise and resistance, and that selling would more than likely be the best way to go. In other words, it’s almost impossible to imagine buying this market under any circumstance.

European Central Bank

The ECB should continue to loosen its monetary policy as the European Union continues to struggle economically. On top of that, the United States is by far one of the best economies that we can find in the G 10, and as a result the US dollar should continue to strengthen overall, especially against the Euro which of course is in so much trouble.

The Federal Reserve has left the quantitative easing game, and as a result the US dollar should continue to strengthen against most currencies. With that, I am not willing to sell the US dollar anyway, so that really only leaves one direction to trade this market, down. Granted, we will have bounces from time to time, but I look at that as potential “value” in the US dollar as it should continue to strengthen overall based upon the US Dollar Index, and many other fundamental factors around the world as America continues to strengthen.