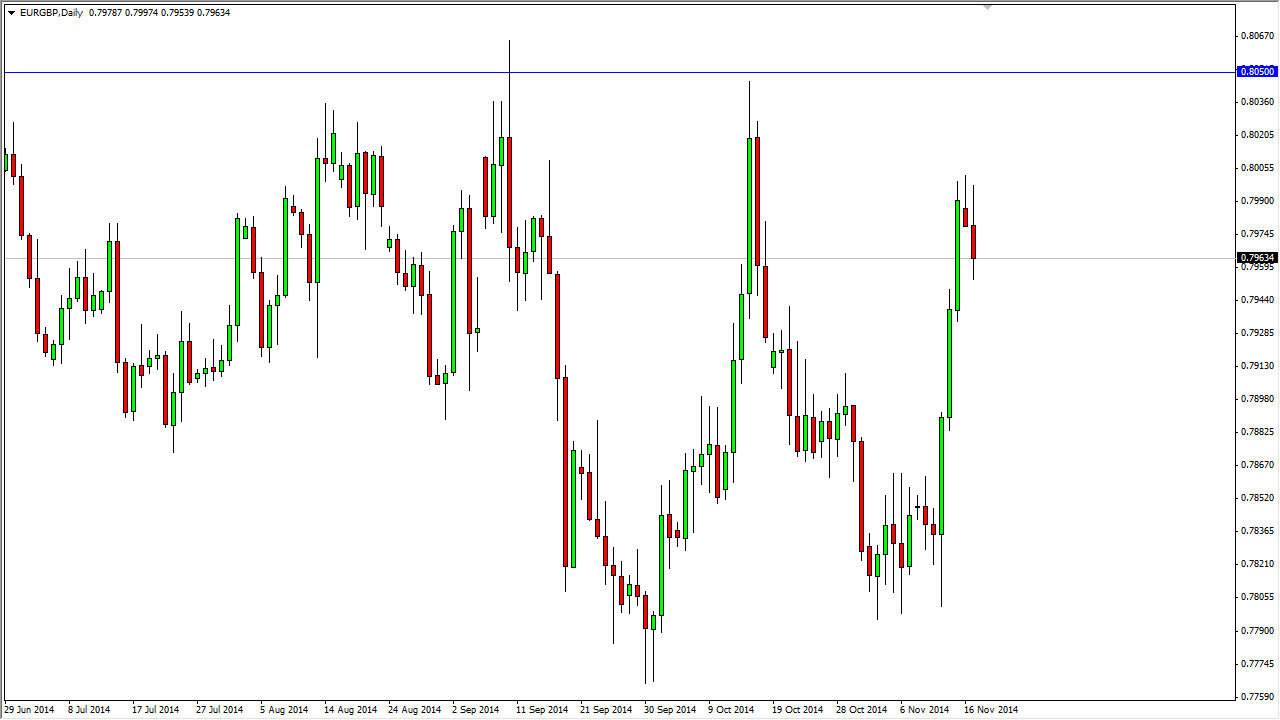

The EUR/GBP pair fell during the course of the session on Monday, as we reached for the 0.80 handle, which of course is an obvious large, round, psychologically significant number. It is also the beginning of significant resistance all the way to the 0.8050 level, which of course is also significant resistance in what is an obvious consolidation area. The bottom of this consolidation area is closer to the 0.78 handle, so I think there is a bit of room to run to the downside. That can be wrong, I recognize that there are various supportive areas between here and there, but the move higher has been so parabolic that it almost makes to be retraced.

Keep in mind that this pair typically doesn’t move in a parabolic fashion. It likes to grind because the two economies are so intertwined. I don’t see that being any different now, so quite frankly I expect this to be a very choppy move on the way down. The fact that we rose that quickly tells me that the market is certainly overextended for its usual movement, and therefore has me suspicious.

Remember, it’s about relative value

Both of these currencies are going soft against the US dollar, but quite frankly it’s the Euro that is weakening against almost everything on the planet. Because of that, I feel that this market should fall from here, and with the German ZEW Economic Sentiment numbers coming out later today, it’s very likely that we will see quite a bit of volatility. Quite frankly, that could be the catalyst to push the Euro down anyway, and as a result I feel fairly confident in shorting this market where we are presently.

It’s not until we break above the 0.81 level that I would consider buying this market now, and that of course is something that I don’t anticipate seen anytime soon. I think that this market will continue to go sideways overall, but we do have a nice 200 point region to play back and forth, which is exactly what I am planning on doing over the next several weeks.