By: YesOption

In the latest move to bring Bitcoin to the masses, Bitpay launched a new sale app called Bitcoin Checkout for in-store payments. BitPay, in a statement said that it is very excited with the new tap payment feature, which uses the NFC capabilities of mobile phones. This will send Bitcoin payment instructions directly to users’ mobile phones. The app is currently available on the Android marketplace and should be released for IOS devices in the next couple of weeks. BitPay is of the view that the mobile payment option is not only an advantage for users but also for merchants, especially for those who have an international customer base.

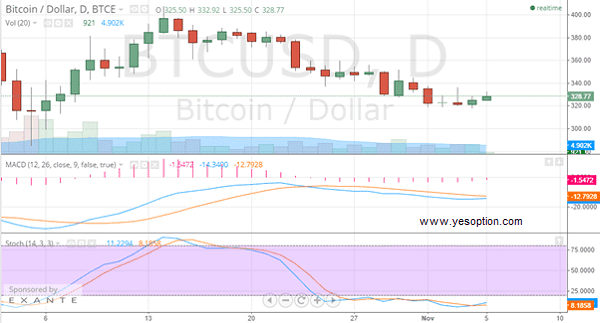

The BTC/USD showed some semblance of buying interest during yesterday’s trading session. The positive bias continued into today’s Asian-morning session, but the crypto-currency continues to remain below its resistance zone. Additionally, the BTC/USD continues to trade below its daily moving averages, which is indicative of the strong-selling pressure present at current levels.

The resistance level for the BTC/USD continues to remain near the $345 levels, whereas support on the downside is around the psychological level of $300. It is imperative to state that the BTC/USD has broken its triangle formation, which is a bearish signal. Furthermore, the stochastic oscillator has given a fresh buy signal, but low volumes continue to concern analysts. The momentum indicators for the BTC/USD continue to remain in bearish territory and show no signs of reversing in the near-future.

Actionable Insight:

Long the BTC/USD if it moves above $347 for a short term target at $375, with a strict stop loss below $320

Short the BTC/USD if it moves below $318 for a short-term target at $280 with a strict stop loss at $337