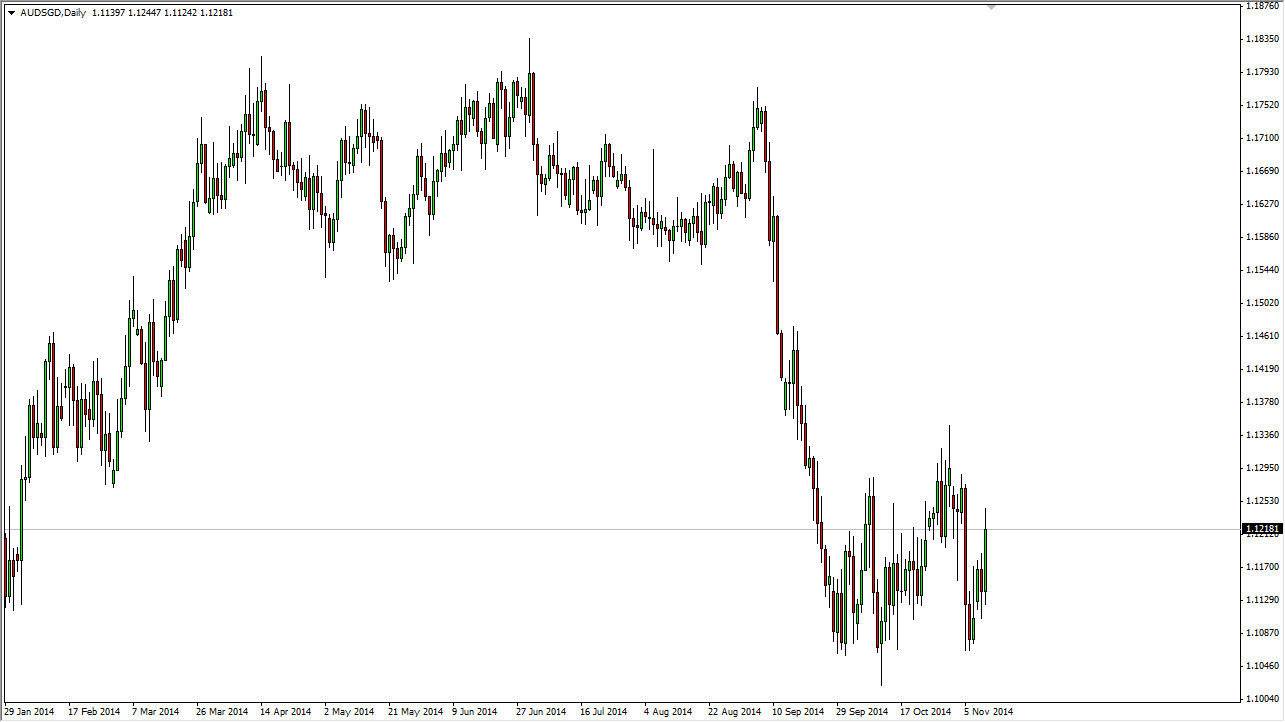

The AUD/SGD pair rose drastically during the session on Tuesday, as the market continues to show signs of consolidation. The fact that we had a nice impulsive candle to the upside of course is a strong sign, but at the end of the day we see quite a bit of resistance at the 1.13 level. With that being the case, the Australian dollar will probably struggle to gain much more than that against the Singapore dollar. After all, the Aussie is a bit more of a risk tolerant currency, as the Singapore dollar is a little bit more along the lines of an “Asian Swiss franc.” Because of this, you have to keep in mind that the Singapore dollar gains strength when fear is in the marketplace.

Remember that the gold markets can greatly influence the Australian dollar, and that shows that the market is simply bouncing around just as the gold market is. That being the case, the market will more than likely struggle at the 1.13 level, just as the gold markets continue to struggle near the $1200 level. On top of that, it’s very difficult to imagine that we are simply going to have a massive “risk on” type of marketplace around the world.

Continue consolidation, continued downtrend.

Ultimately, we believe that the downtrend probably continues going forward. After all, looking at this market we are most certainly in a bearish market, and it’s probably only a matter of time before we break down below the 1.10 level, which of course since this market much lower levels. It should coincide with gold markets falling down to the $1000 handle, so we’re actually bearish of both markets. Ultimately, it’s only a matter of time before that happens in our opinion, and as a result we have no interest in buying this market. We simply look at a bounce back towards the 1.13 level as a potential selling opportunity. This market has a fairly tight spreads, so those of you who are not used to treating it should heal fairly comfortable.