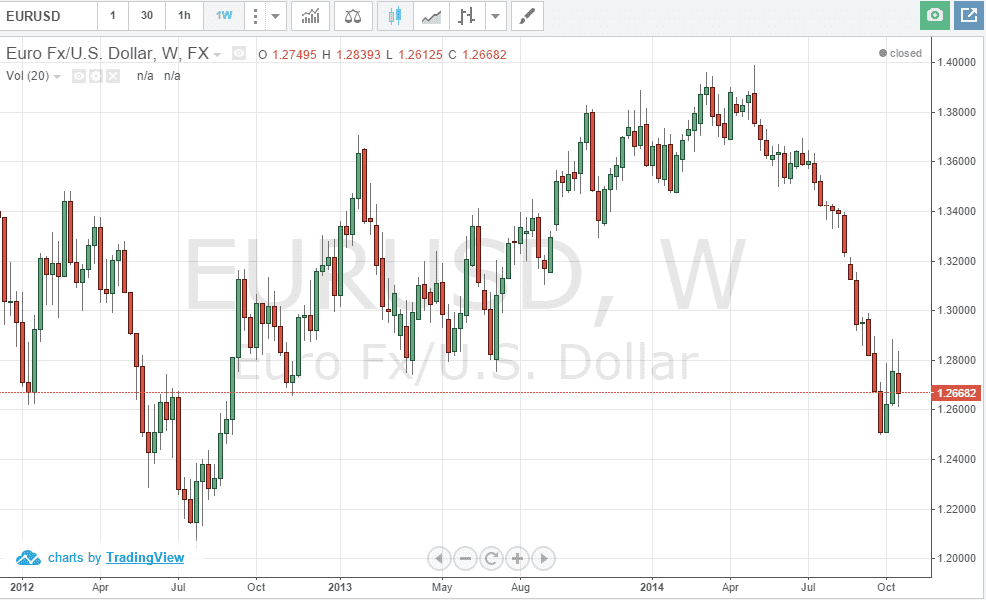

EUR/USD

The EUR/USD pair originally tried to break out of all the point to a level during the week, but as you can see struggle about that area and therefore continues to show that the sellers are most certainly in control over the longer term. With all the concerns coming out of the European Union, this of course isn’t much of a surprise. I believe that the market will continue to drop from here, and probably head towards the 1.25 level. It’s in that area that I would anticipate a significant amount of support to be found yet again, however I believe we will continue to go lower, and head towards the 1.2050 level.

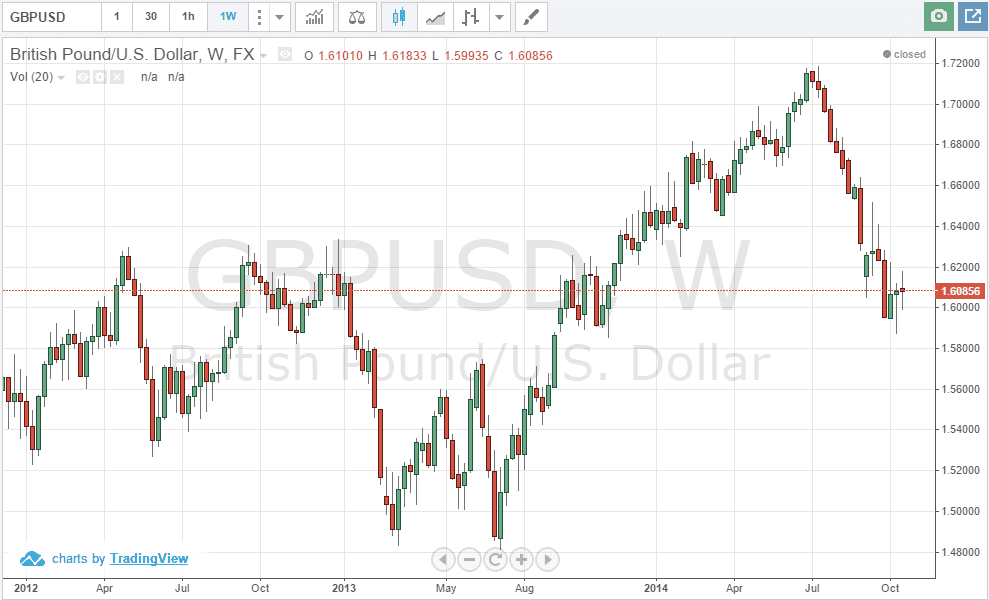

GBP/USD

The GBP/USD pair had a very volatile week, essentially forming a neutral candle. However, we did break above the top of the hammer from the previous week and I believe that the market is slowly starting to show signs of buyers stepping in and picking up the British pound overall. I also look around the Forex markets and see that the British pound is starting to show signs of support everywhere. Because of this, I believe that a break of the top of the range for the week is more or less a buy signal.

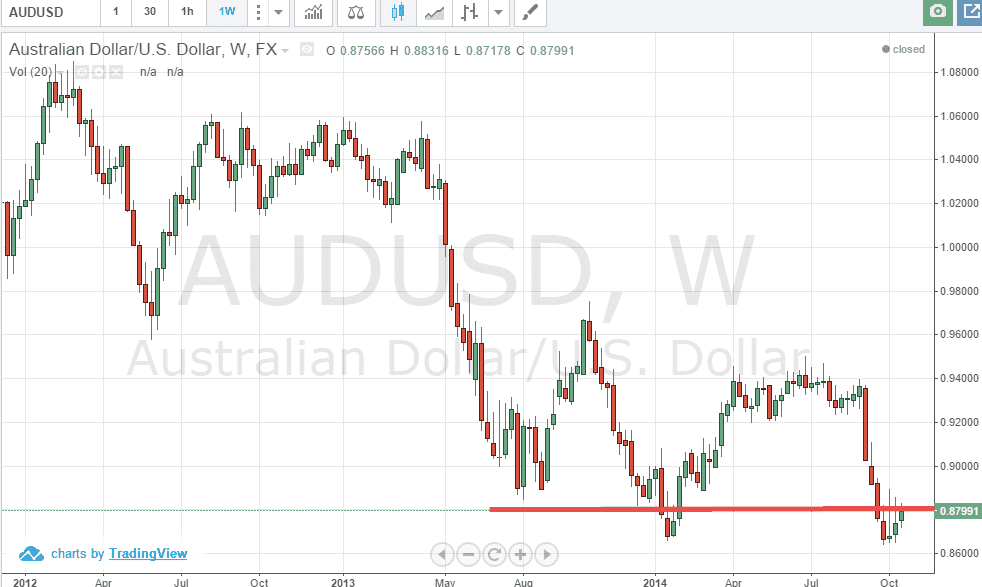

AUD/USD

The AUD/USD trying to break out to the upside during the week, but as you can see struggled at the 0.88 resistance barrier yet again. Because of this, I believe that this market cannot be bought until we clear the 0.90 level, something that I do not see happening anytime soon. I believe this market will continue to have plenty of sellers step in and eventually push the Australian dollar down to the 0.85 handle, which is the next large, round, psychologically significant number.

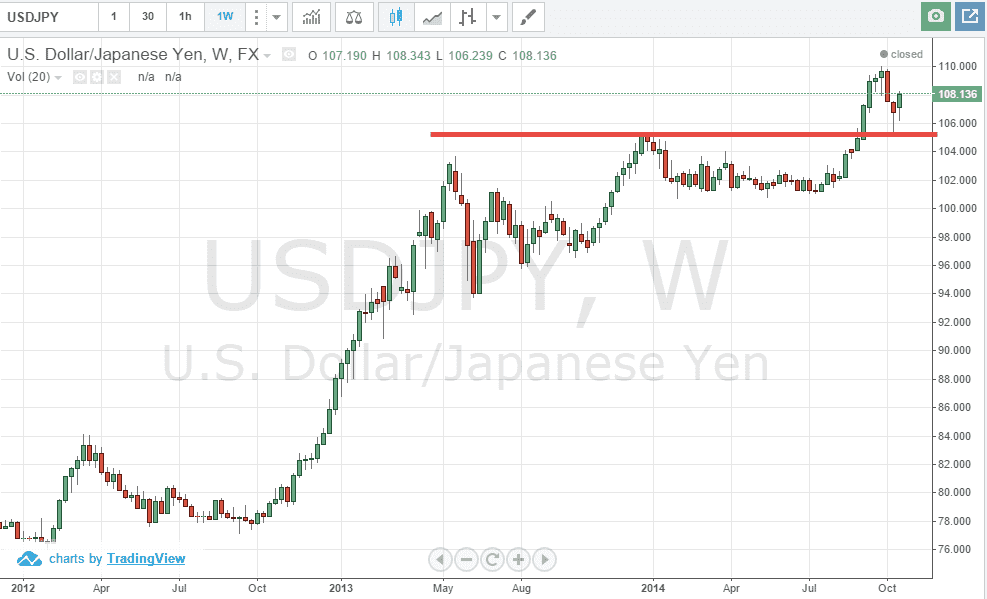

USD/JPY

The USD/JPY pair initially fell during the course of the ultimately bouncing yet again and forming a nice-looking hammer for the second week in a row. Because of that, it’s very likely that the market is going to continue to find buyers every time it pulls back. With that being the case, I believe that we will eventually hit the 110 level, and quite possibly break out above there in order to go as high as 115 given enough time. I continue to buy pullbacks every time it happens in this pair.