The USD/MXN pair is one that many of you will not have traded in your careers. However, it is a very interesting longer-term pair as it has several different dynamics involved in it. Most people don’t understand this, but the Mexican peso tends to be thought of as an oil-based currency. After all, a majority of the oil rigs in the Gulf of Mexico are in fact Mexican. With that being the case, this can often move in concert with the oil markets and as they have been very bearish over the last several weeks, you can see that the currency pair has of course acted in favor of the US dollar as one would expect. Because of this, I will often play this pair in response to what’s going on in the oil markets.

There are other factors

The interest-rate differential most certainly favors the Mexican peso, but the US dollar is certainly a much more stable and secure type of investment. On top of that, there are other things to think about. After all, the Mexican peso is probably one of the best ways to play Latin America via the currency markets. So if there is something that is going on in Latin America, you will often see it reflected in the value of the Peso.

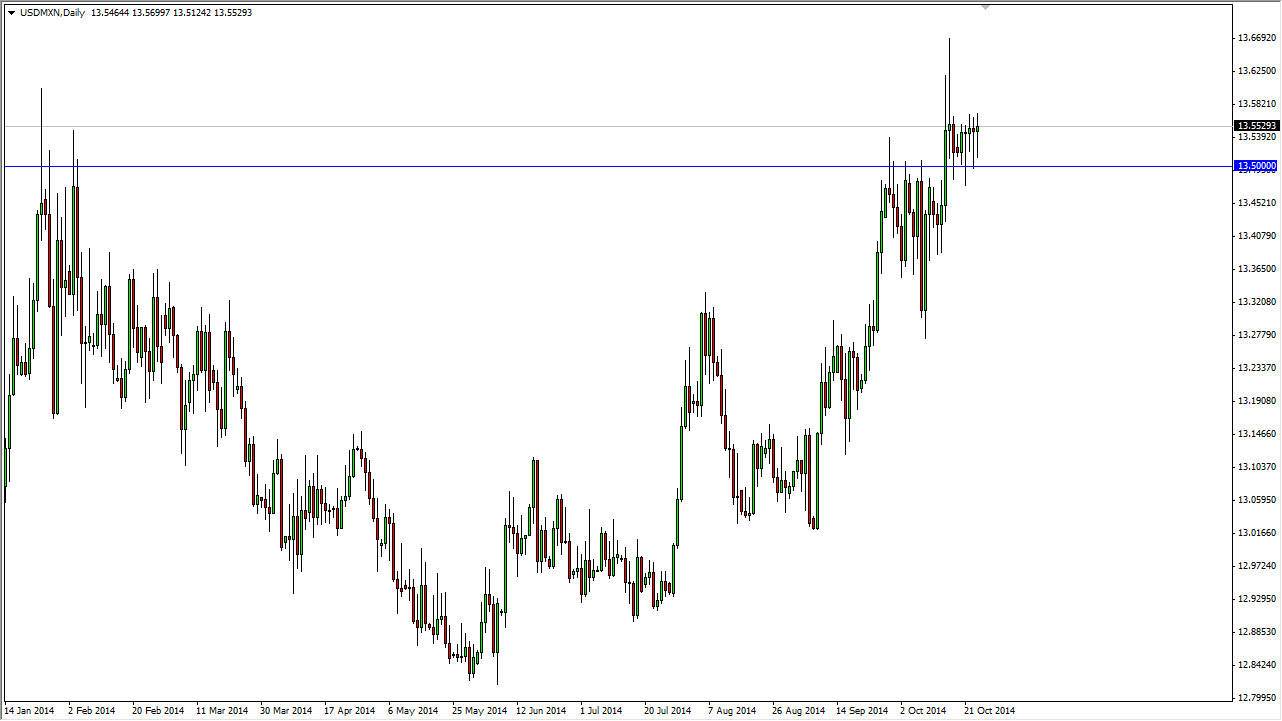

Looking at the chart, you can see that the 13.5000 level has offered support over the last several days. Because of this and the fact that we have formed several hammers, I am willing to go long of this market because quite frankly I don’t want to sell the US dollar anyway. With that, I believe that this market should go much higher, and that buying in this region is probably a worthwhile investment. However, do not think of this is a short-term trade and recognize that it is just that: an investment. Keep in mind that this market tends to trade most of its volume in the North American timeframe, but quite frankly if you are trading for a little bit longer term, that shouldn’t have much of an effect on how things turn out.