USD/JPY Signal Update

Yesterday’s signals expired without being triggered. We did reach 109.13 but there was no bullish action there and it only proved to be supportive briefly.

Today’s USD/JPY Signal

Risk 0.75%

Entries may be made until 5pm New York time and then from 8am Tokyo time until 8am London time tomorrow.

Long Trade 1

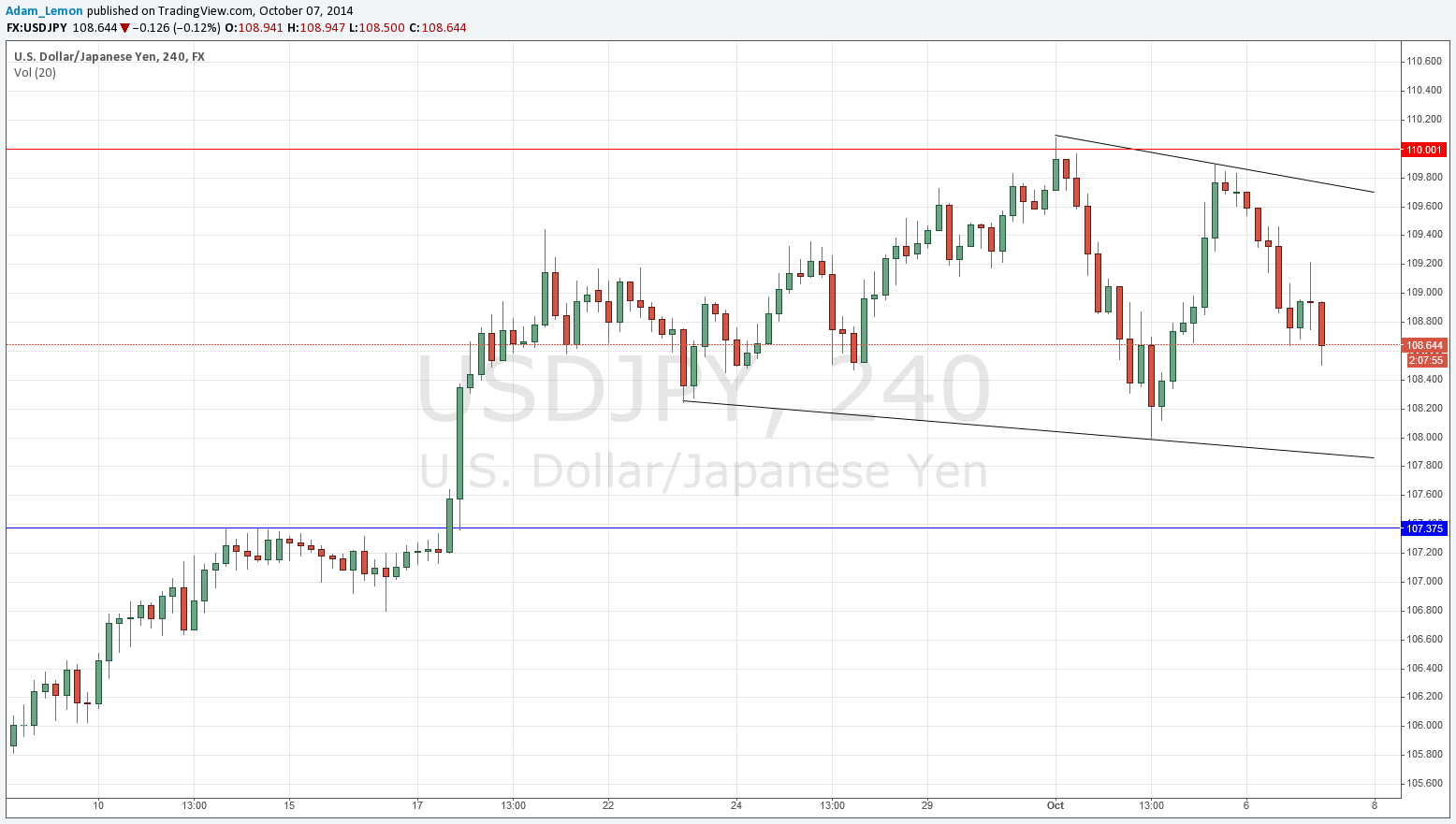

Go long following bullish price action on the H1 time frame following a first touch of the descending lower channel trend line shown on the chart below, currently at around 107.90.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride. Ensure the risk is taken off the trade.

Long Trade 2

Go long following bullish price action on the H1 time frame following a first touch of 107.38.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride. Ensure the risk is taken off the trade.

Short Trade

Go short following bearish price action on the H1 time frame following a first touch of 110.00.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride. Ensure the risk is taken off the trade.

USD/JPY Analysis

I forecast yesterday that the price was likely to fall and it did. I also said that the JPY looked like the strongest currency after the USD so would probably not be the best pair to pick to trade an advantage from expected renewed USD strength. These were correct observations and in fact we fell quite heavily. We are now well below 109.00.

Technically we seem to be forming a wide bearish channel, and the closest point for an obvious long entry would be off that lower trend line should we arrive there, although it is beneath the lows of the past 2 weeks.

My colleague Christopher Lewis is not ready to go short on this pair until the price falls below 105.00. He has a more long-term style than I do but I think there could be good short opportunities before we reach that price that could easily yield 3 figures in pips.

There are no high-impact data releases scheduled for today which are likely to directly affect either the JPY or the USD, provided that the Bank of Japan’s press conference has ended by the time of publication. Therefore it is likely to be a quiet day for this pair, at least until such a statement may be made.