USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Entries must be made either before 5pm New York time or after 8am Tokyo time before 8am London time tomorrow.

Long Trade

Long entry following bullish price action on the H1 time frame following a first touch of the bullish trend line at about 108.75.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Nothing much happened yesterday although as I wrote, this pair continues to look like the best pair of choice to benefit from any continuation of USD strength.

Yesterday we saw a bit of a pullback but certainly there was no bearish capitulation. At the moment of writing just after the London open, it looks like things could go either way.

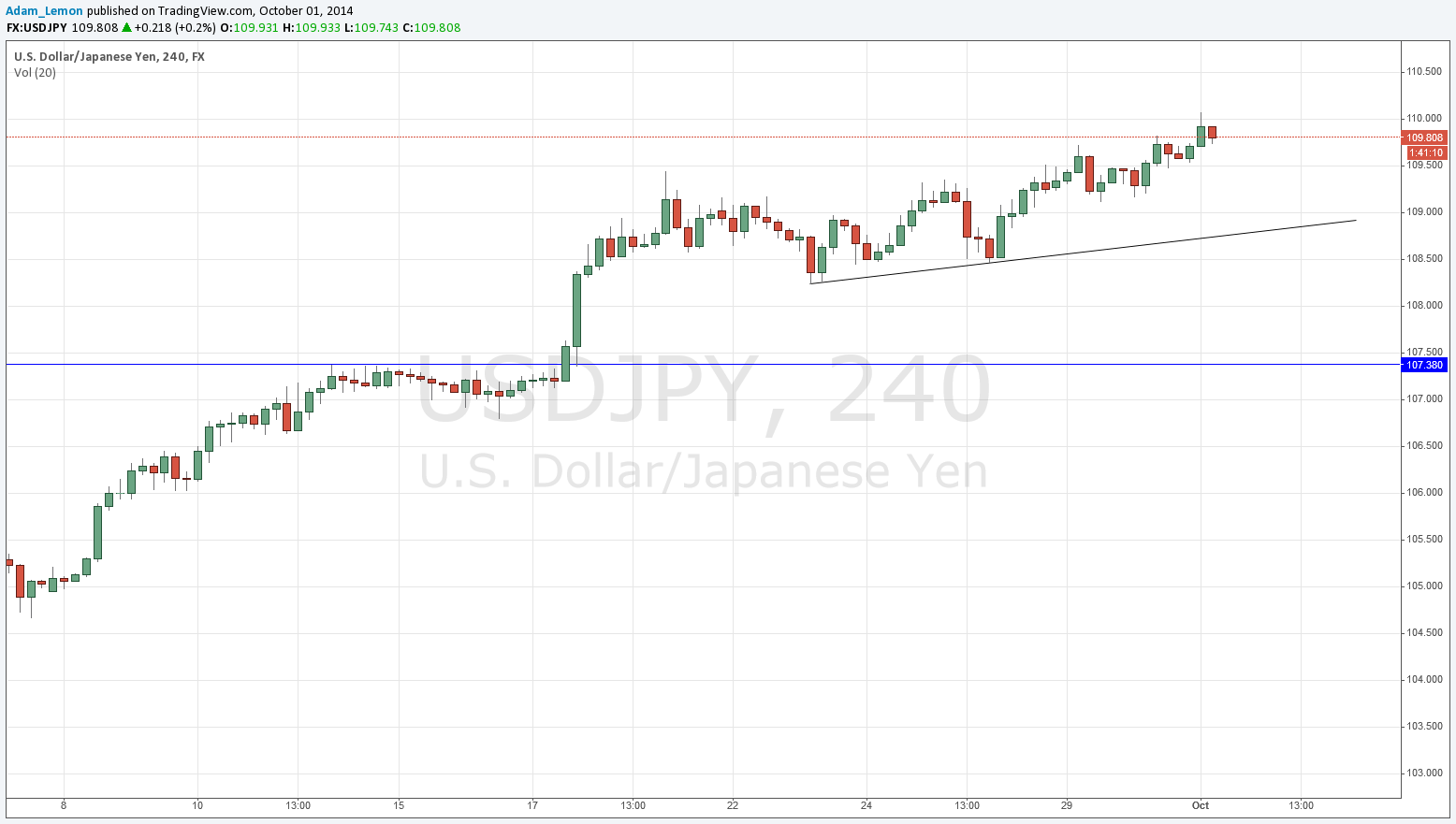

I see the same possibilities for entry as there were yesterday: primarily off the short-term bullish trend line shown in the chart below at around 108.68. There are no obvious flipped levels before the 107.50 area which might also be a key level if there were to be a deeper pullback.

Above us the natural psychological resistance would be at 110.00.

There are no high-impact data releases scheduled for today which are likely to affect the JPY. Regarding the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm London time. Later at 3pm, there will be a release of ISM Manufacturing PMI data. Therefore this pair is likely to be relatively quiet until the New York session begins.