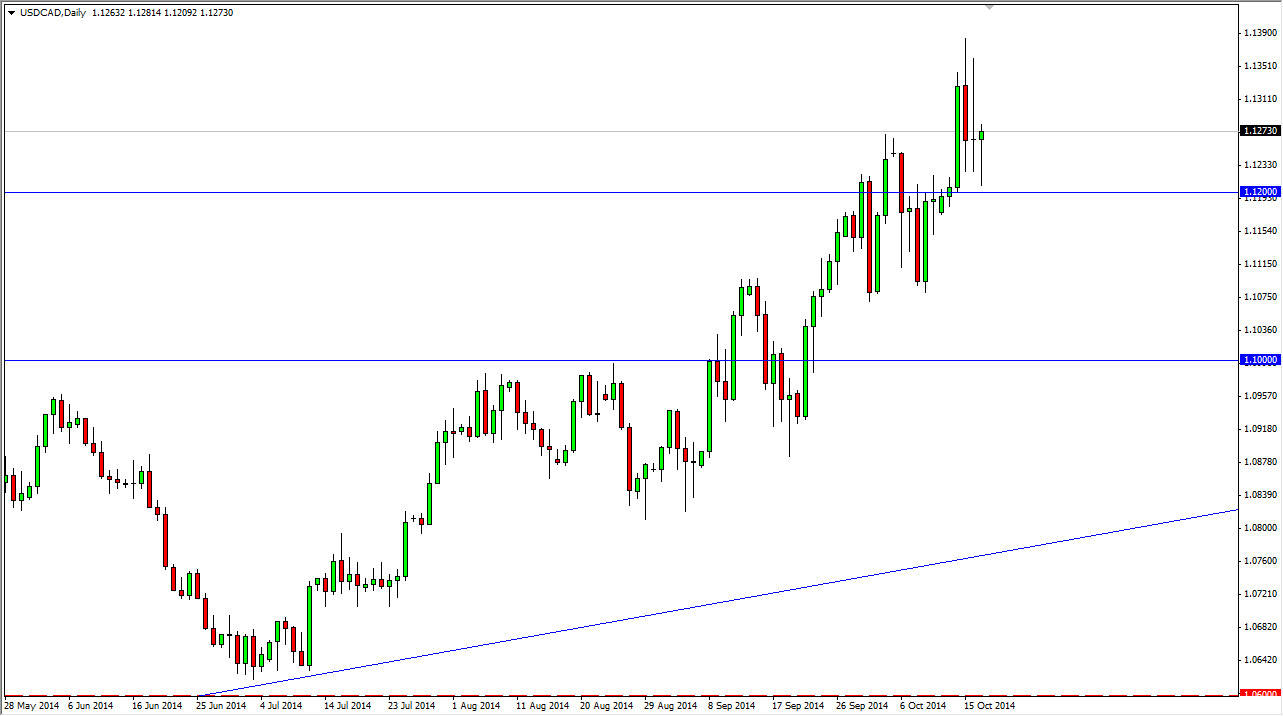

The USD/CAD pair tends to be rather choppy in general, and the most recent action certainly will do nothing to dissuade traders from thinking so. When you look at the weekly charts, the last two weeks have produced in order: a hammer, a hammer, and now a shooting star. Because of that, I still believe that this market has some grinding to do and although we formed a hammer on the Friday session, and I am most certainly bullish of this market, it’s not necessarily going to be the easiest one to hang onto through all of the volatility that we will undoubtedly see.

With that being said, I still am bullish and feel that the market on a break above the top of the hammer could offer short-term buying opportunities. On the other hand, if we broke below the 1.12 level, although we would be breaking down below the bottom of the hammer, I still think that there is plenty of support all the way down to the 1.11 level, keeping me from selling this market.

Canadian dollar getting no help

Although the recent Canadian numbers have been fairly decent, the reality is that the oil markets are most certainly not doing anything to help the value of the Canadian currency. After all, they are absolutely falling apart and there seems to be very little in the way of demand outside of the United States, which is tepid at the moment. Because of that, I don’t see much driving the value the Canadian dollar higher over the longer term, at least not against the US dollar. Sure, the Canadian dollar will probably get a little bit of the “knock on effect” of simply being a North American currency, and therefore could rise against other currencies such as the Euro or the Yen, but the greenback is going to be a completely different story. With that, I am most certainly not interested in selling, and I do still believe that we go to the 1.15 handle. However, do not expect that move to be quick or easy.