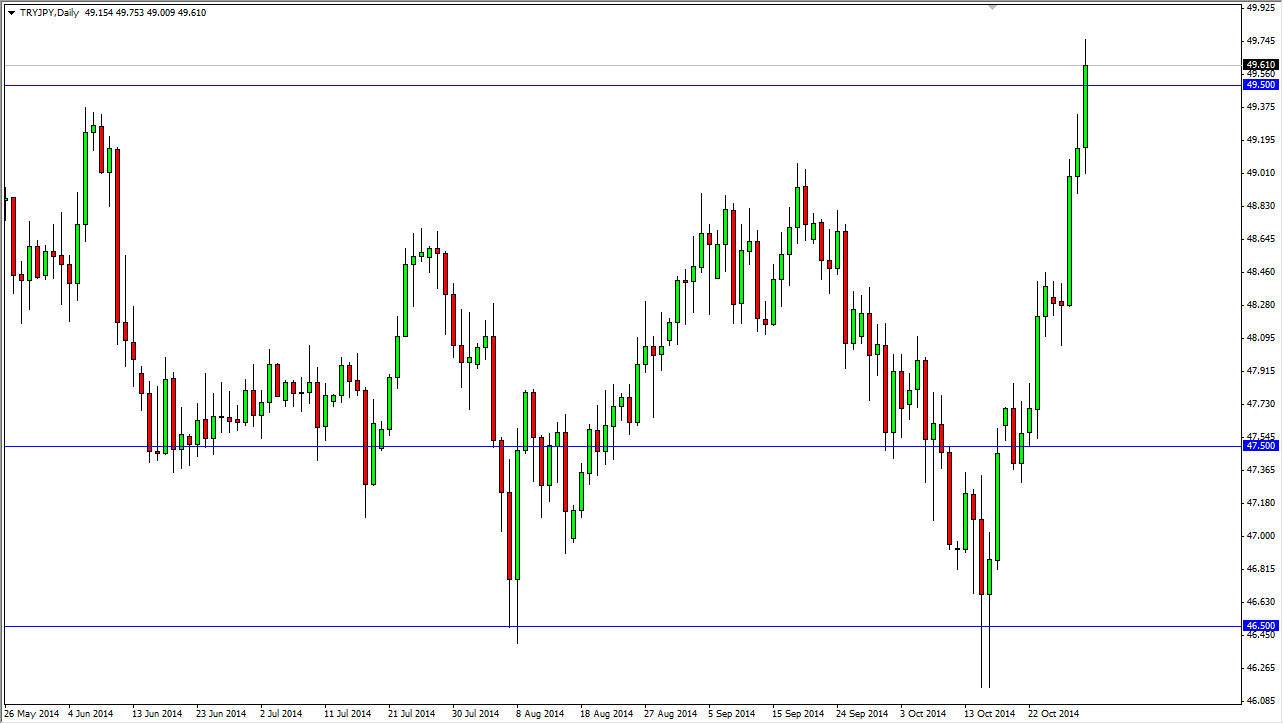

The TRY/JPY pair broke out during the session on Thursday, eclipsing the 49.50 resistance barrier. With that being the case, it appears of the market is ready to go much higher, and although it has been a fairly parabolic move, this pair can move drastically and in short order. After all, the Turkish lira being traded against the Japanese yen is in exactly the first thing you think of when you start trading Forex. This is a high swap trade, as the positive swap is rather large compared to most other currency pairs. Because of this, I tend to prefer to have a long position in this market over the longer term as I look at it as more of an investment than anything else.

The Japanese yen continues to get sold off against most other currencies, and with the Bank of Japan having an interest rate decision and rate statement today, it’s likely that we could see more volatility in the Japanese yen. In fact, I believe that the market will continue to sell off the Japanese yen, and that any pullback at this point in time should be a buying opportunity and almost any currency versus the Yen.

Longer-term uptrend, will continue going forward

I believe that longer-term uptrend will continue in this pair, as the Bank of Japan continues to try to knock down the value of the Yen in general. The Turkish lira and its high yielding interest-rate is exactly what we like to see for longer-term trades in the Forex markets. As long as there is stability in Turkey, and while that can vary from time to time, it appears that the Lira should continue to be favored over the Yen. After all, this is a currency pair that tends to fluctuate with risk appetite, meaning that the higher it goes the more “risk on” the markets in general should be. Ultimately, I believe that the 49 level should be supportive, and I’m willing to buy pullbacks all the way down to their on signs of support. I am also willing to buy a break out above the top of the range for the session on Thursday.