By: YesOption

Google Inc. (NASDAQ:GOOG) launched the newest version of its Android operating system “Lollipop”, which it believes will take away any security glitches that previous Android versions had. According to reports from company officials, the security features in the newest version will set itself and keep user data safe, which undoubtedly is a tremendously positive sign for consumers. One of the novel things that its new operating system will provide for its users is a “kill switch”, which would disable stolen devices. Furthermore, Google is now no longer just focussing on the smartphone industry, but is additionally positioning itself to jump into the wearable-tech market.

In other related news, Google teamed up with accounting firm PricewaterhouseCoopers to bring new and innovative services to companies. This move now fully enables the company to compete with the likes of Microsoft and other companies that provide cloud computing services.

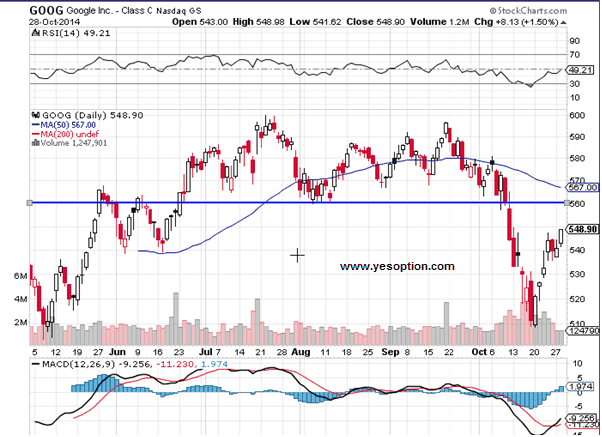

When looking at the daily chart for Google, the stock has formed a very strong base near the $510 level after being caught in a strong downwards trend over the past few weeks. Additionally, it fell below its daily-moving average, which is clearly a bearish sign. However, at the current level, its momentum indicator is giving a buy signal, which is indicative of a future shift towards the buy side.

Currently, the relative strength index is providing a buy signal, forming a higher high, which analysts view as encouraging. Lastly, the next level of resistance for the stock comes at around the $560 level.

Actionable Insight:

Long Google Inc. (NASDAQ:GOOG) at current levels for a near term target at $560, with a strict stop-loss below $532

Short Google Inc. (NASDAQ:GOOG) if it closes below $532 for an intermediate target at $510