The XAU/USD pair extended its gains yesterday and hit the highest level in eight sessions as the American dollar weakened across the board after minutes from the Federal Open Market Committee's September policy meeting showed that interest rates could remain highly accommodative longer than previously thought. The records also highlight worries about slowing global growth and a stronger dollar. “Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector” according to the Fed minutes.

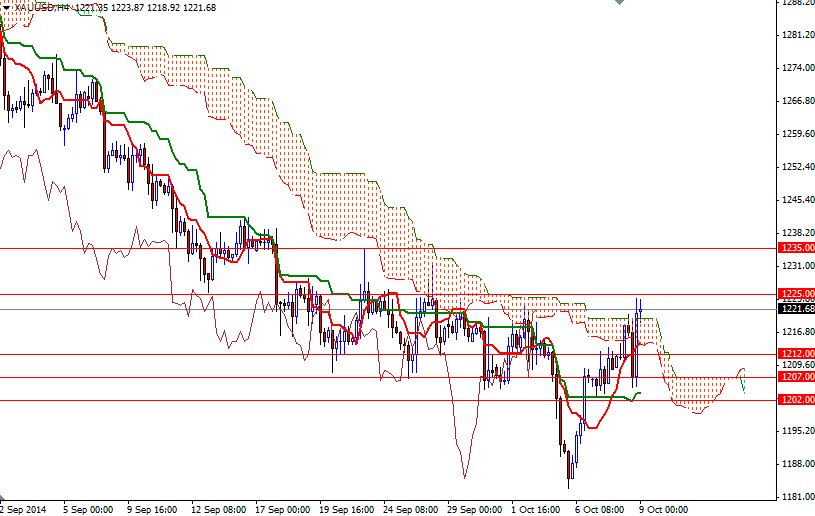

It appears that Federal Reserve officials are still in no hurry to start tightening and the gold bulls are taking advantage of the situation. Currently the XAU/USD pair is trading above the Ichimoku cloud on the 4-hour time frame and we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross. So speaking strictly based on the charts, it is likely that the pair will run higher as long as the market holds above the 1214/2 area.

However, the bulls have to pass through the barrier around the 1225 level so that they can march towards the 1240 resistance level. On its way up, there will be hurdles such as 1229.50/1230 and 1235. If the bears manage to defend their camp at 1225 and prices start to retreat, expect to see support at the 1219.70 and 1212 levels (which define the borders of the clouds on the 4-hour chart). Breaking below 1212 would suggest that 1207 level will be the next stop.