The XAU/USD pair rose for a fourth day this week as Federal Reserve's concerns over a global economic slowdown stoked speculations that interest rates will remain low until the fourth quarter of 2015. Although the central bank wants to assure markets that borrowing costs would stay low "considerable time" to support growth, conflicting messages from officials have left investors completely confused. According to Federal Reserve Vice Chairman Stanley Fischer "considerable time" refers to between two months and a year. San Francisco Fed President John Williams said "Likely around the middle of next year is a reasonable guess to my mind" and underlined that "the decision to raise rates will be data-driven, not date-driven". Federal Reserve Bank of Richmond President Jeffrey Lacker told "At this point it’s too soon to draw conclusions about when we lift off".

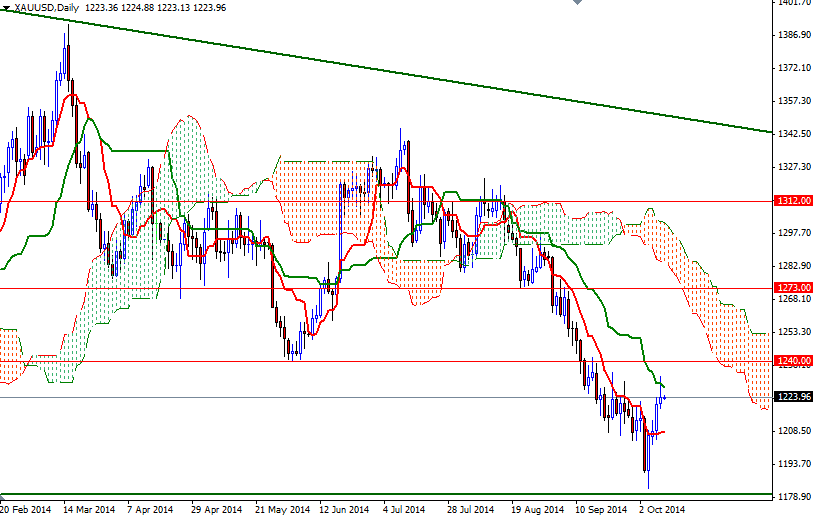

Apparently Federal Reserve policy makers want to make sure that the economy is on a solid trajectory before they pull the trigger and in the meantime they are trying not to spook the markets. Currently the XAU/USD pair is trading between the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) on the daily chart. Yesterday, the market encountered resistance around the 1235 level as expected and erased some of earlier gains.

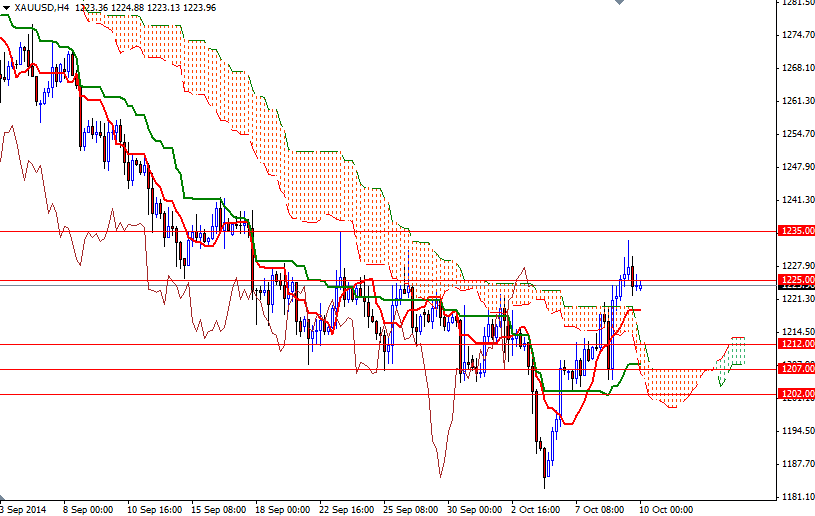

From an intra-day perspective, I think the key levels to watch will be 1225/8.20 and 1219/8.

If the bulls push prices above the 1225/8.20 area, they may have another change to test the 1235 resistance level. Only a close above this level could give the bulls the extra strength they need to tackle the 1240 level. However, if the bears increase the downward pressure and drag the market below the 1219/8 support, the pair will most likely head for 1212. Breaking below 1212 would indicate that the market wants to revisit 1208.08 - 1207.