Gold prices rose 2.6% over the course of the week as the U.S. Federal Reserve's dovish stance and steep falls in stock markets on either side of the Atlantic buoyed the precious metal's appeal. The XAU/USD pair managed to close Friday's session above the Ichimoku cloud on the 4-hour time frame although the American dollar got a boost after Standard and Poor's cut France's credit outlook to negative. Data from the Commodity Futures Trading Commission (CFTC) show that speculative investors increased their net-long position in gold (for the second consecutive week) to 66447 contracts, from 64870 a week earlier.

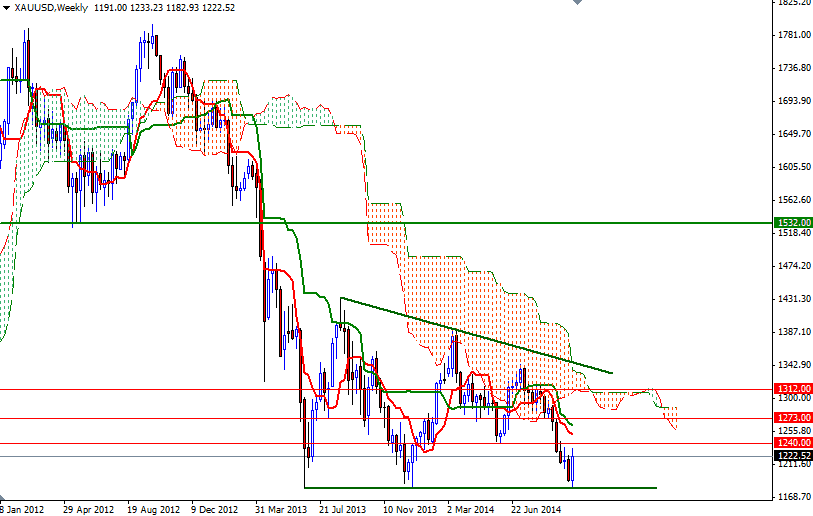

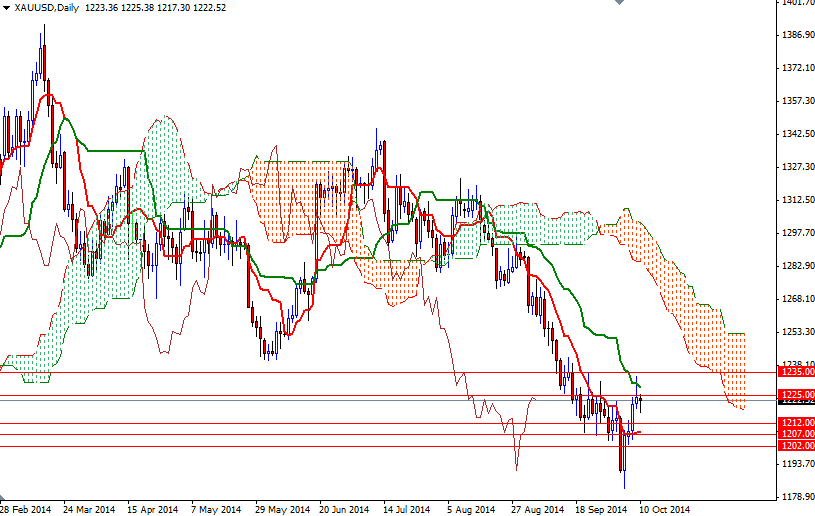

The major equity markets have been losing strength since minutes from the Federal Reserve's September 16-17 policy meeting highlighted risks to the nation’s economic outlook. Heightened risk aversion is likely to provide support to the safe haven gold but demand for the highly liquid dollar might limit the shiny metal's gains. From a technical point of view, short-term and long-term charts are giving us mixed signals. The 4-hour and daily charts are favoring the bulls at the moment but prices are still below the Ichimoku cloud on the weekly and daily time frames.

Last week's candle which engulfed the previous one makes me think that prices will have a tendency to rise towards the critical 1240 level which caused prices to pause or reverse several times in the past. On its way up, expect to see resistance at 1225/8.20 and 1235. Once the XAU/USD pair breaks through this resistance point that will probably bring more buyers in and then we could see a test of the 1258 level. If the market can't get through it, that will probably encourage the sellers a little bit. The bottom of the clouds on the 4-hour chart currently sits around the 1207 level and there is an interim support at 1212. If the XAU/USD pair closes below the 1205 level on a daily basis, the market might make a bearish attempt to break the support at 1182/0.