Gold weakened against the American dollar for a third straight session as weakening demand continued to lure investors away from the market. The XAU/USD pair fell below the $1208 support level and traded as low as $1204.45 (the lowest level this year) but recovered some of losses and closed at 1207.95 after a series of U.S. economic data fell short of market expectations. The Chicago purchasing managers index came out worse than expected with a print of 60.5 and a report released by the Conference Board showed that its consumer confidence index declined to 86.0 from 93.4 the prior month.

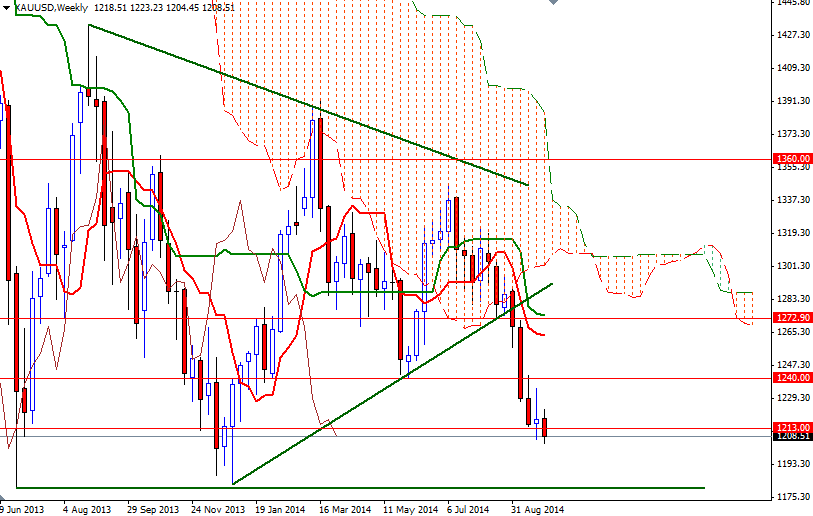

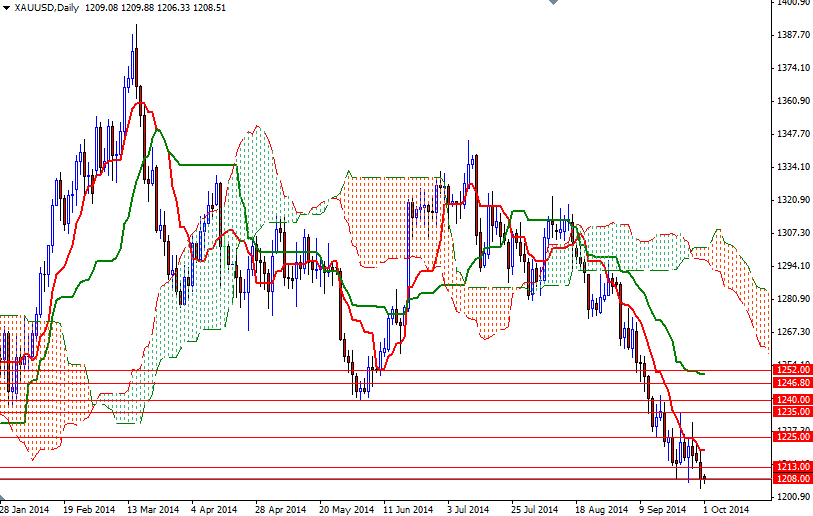

The mild disappointments in U.S. data failed to have a lasting impact on the markets and I think this is something to pay attention. Technically speaking, the weekly and daily charts are still bearish while the pair is trading below the Ichimoku cloud. We also have bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses almost on all time frames. In other words, further downside risk is still valid and the 1200 level looks like the next port of call.

As mentioned in my previous analysis, I don't see any technical reason to go long and until the general outlook changes, signs of weakness are what I am looking for. From an intra-day perspective, I think the XAU/USD pair has to push its way through the 1213 resistance level in order to gain some traction. Beyond that, expect to see resistance between the 1218.50 and 1225. To the down side, I think the first critical support is located around the 1200 level. If this support gives way, 1194/3 and 1182/0 will be the next possible targets. Today sees release of closely watched economic reports from the United States such as ADP non-farm employment change and ISM manufacturing PMI, so expect volatility.