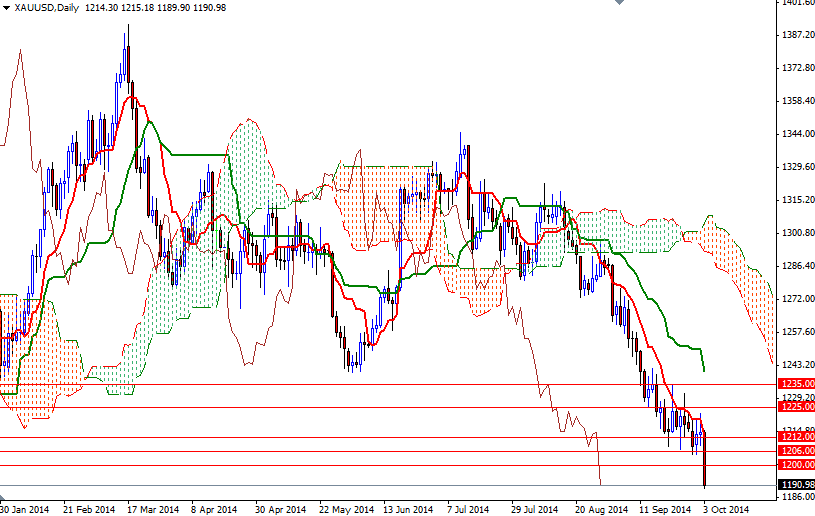

Gold prices settled at their lowest level since August 2010 as Friday's bearish price action dragged the market below the 1200 support level. Gold prices fell sharply on the last trading day of the week and month after the economic data released from the Unite States provided further evidence that the labor market is continuing to improve along the lines that the Fed expected. September non-farm payrolls came in at 248K, far surpassing consensus estimates for print of 216K with the unemployment rate unexpectedly falling to 5.9% from 6.1%.

A plunge in U.S. unemployment to the lowest level in six years reinforced the view that the Federal Reserve will lift rates off of zero sooner than previously thought. However, while the payrolls report -which the market looks to identify depth of recovery- confirms that from a macroeconomic perspective the U.S. economy is growing, it also shows that wages aren’t growing. That could stop the Fed from increasing the benchmark interest rate by the first quarter. Meanwhile, Friday's data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold (first advance in seven weeks) to 64870 contracts, from 63884 a week earlier.

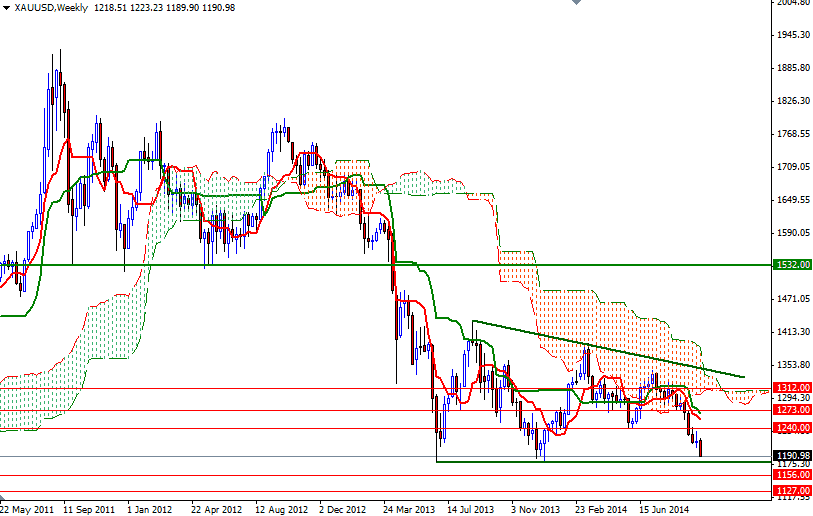

As mentioned in my monthly analysis, there won't any technical reason to buy gold against the American dollar until the general outlook changes. On the other hand, we are approaching the 2013 low of $1180 so it is very likely that the XAU/USD will find some support below the current levels. But of course the market conditions are different from last year and because of that I think it is early to tell if this particular support level will lure enough serious buyers to reverse the course or not. Closing below the 1180 level would suggest that the XAU/USD pair will deepen its losses. If that is the case, I think the bears will be aiming for the next support levels at 1156 and 1127. If the buyers step in and the 1180 support remains intact, we may see the market revisiting the 1196 - 1200 resistance zone.