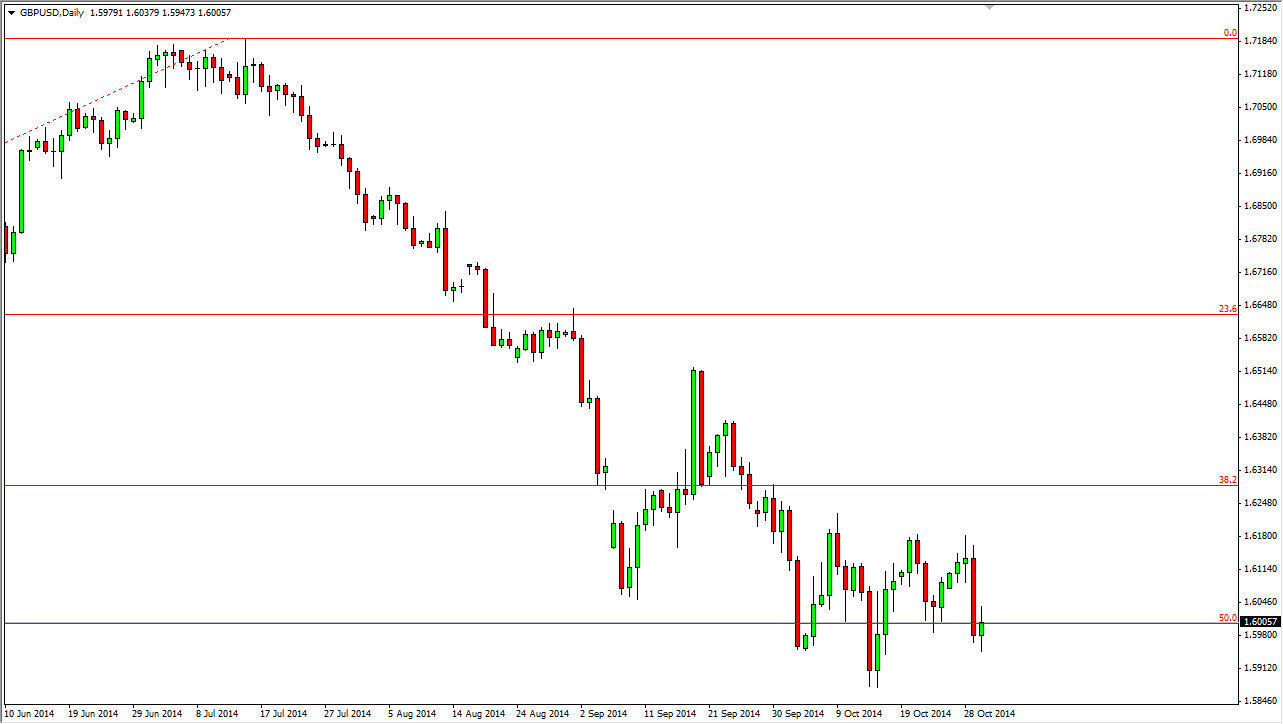

The GBP/USD pair went back and forth during the session on Thursday, showing signs of support as although we broke down rather significantly on Wednesday, you can see that the sellers ran out of momentum, and that the initial shock of the more hawkish than expected Federal Reserve announcement has worn off. That being the case, it appears that perhaps the market will more than likely try to bounce from here, especially considering the fact that on the weekly chart we have formed a hammer during the previous week, which of course is a very positive sign.

Let us not forget that the 50% Fibonacci retracement level is at roughly 1.60 as well, and that of course will attract buyers. I cannot help but notice that although the US dollar has strengthened against most currencies, it really hasn’t made much of a move against the British pound when you look at the totality of it. I think because of that, the British pound is going to continue to be a little bit of an anomaly, in the sense that the US dollar isn’t going to run roughshod over it.

Longer-term uptrend continues

I believe that if we can get above the 1.62 level, the market could continue the longer-term uptrend that we have been in. Yes, we have had one large pullback, but it still is only to the 50% Fibonacci retracement level, and with that it’s very likely that a lot of people will have been paying attention due to that.

That being said, the market could go as high as 1.72 or so, and possibly even higher than that. It seems very difficult for a lot of you to imagine the British pound being so strong, but it wasn’t that long ago when it was worth two US dollars. It might take a while to get that high, but it’s the 1.72 level could probably be had over the course of the next year. I believe that if we do break out to the upside, this will be a “buy on the dips” type of situation. On the other hand, if we break down below the 1.5850 level, that could send this market much lower.