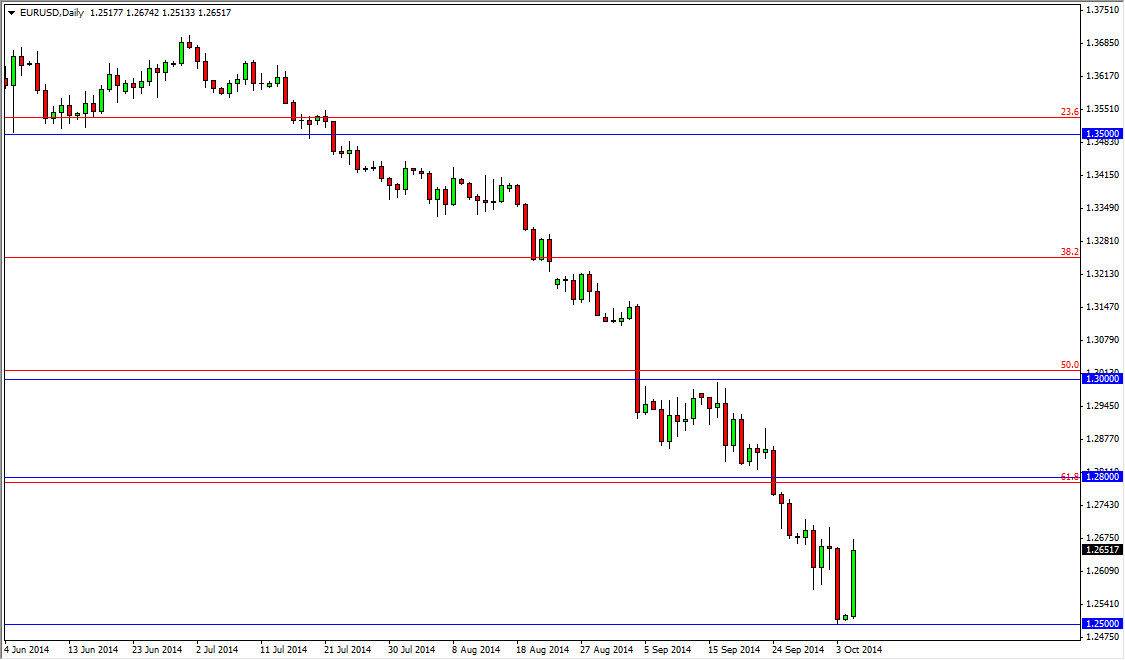

The EUR/USD pair rose during the session on Monday, bouncing off of the 1.25 level. That being the case, the market was is ready to go much higher, in the short-term, but at the end of the day I believe that this market will continue to sell off over the longer term. With that, I am looking for some type of resistant candle between here and 1.28, which is a significant resistance barrier. With that being the case, I also believe that the 1.30 level is the end of that resistance barrier, but I highly doubt that we are going to break above there. With that, a resistant candle between here and the 1.30 level is all I need to start selling again.

I recognize of the 1.35 level below is massively supportive, and a break below there of course would mean something. I think that ultimately this market will go down to the 1.20 handle given enough time, and of course we need to build up enough momentum to actually make it down there. I think that’s what we’re doing now as we continue to try and go much lower.

Massive downtrend

This market is without a doubt in a massive downtrend, so I really don’t see any reason to think about buying this market, unless of course we get above the aforementioned 1.30 handle. Above there, things change of course, but in the meantime I think that this market will continue to be one that short-term sellers will sell rallies, and that long-term sellers are simply hanging onto their short positions.

The market of course will be choppy, because of course there are we see while there who are willing to buy the Euro, but at the end of the day I believe that the ECB will have to loosen its monetary policy, while the Federal Reserve of course is tapering off of quantitative easing. Because of this, I see no reason why this market should continue to go higher for any real length of time and therefore I just simply waiting on the sidelines for that nice selling opportunity I believe will come.