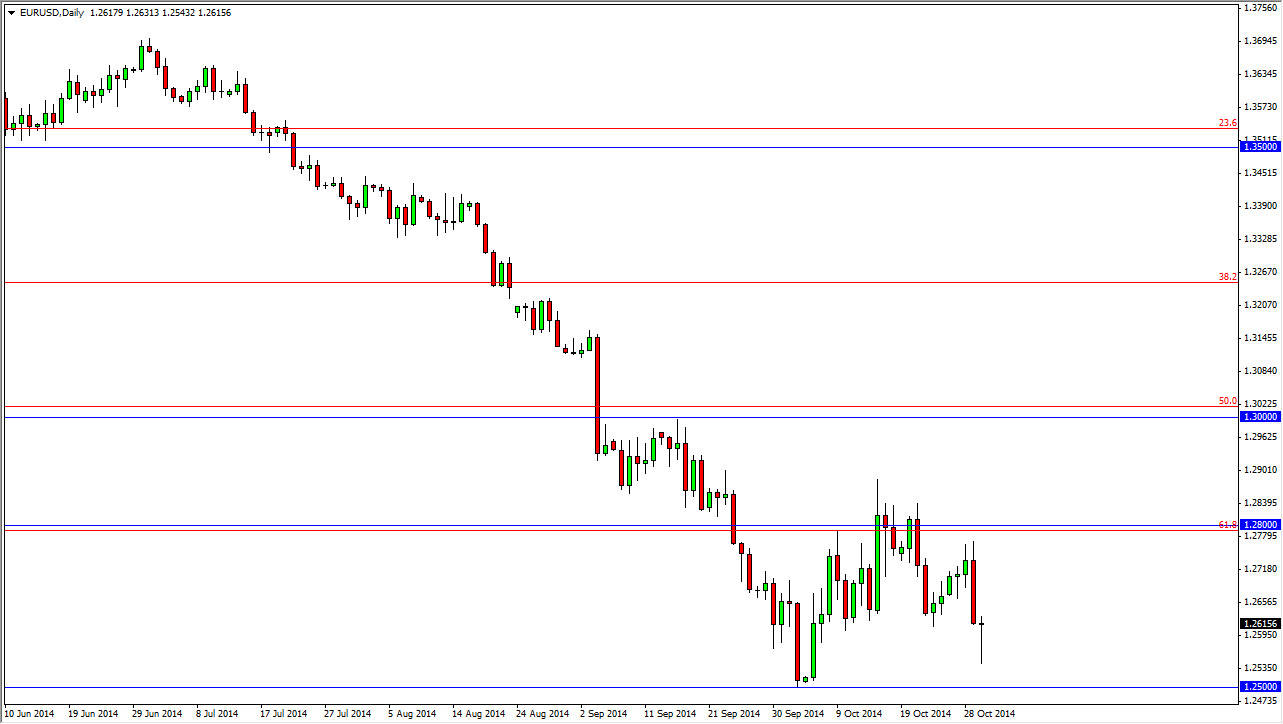

The EUR/USD pair fell during the beginning of the session on Thursday, and as you can see ended up bouncing hard enough off of the 1.2550 level to form a nice-looking hammer. This hammer suggests of course of the buyers are coming back into the marketplace, but at the end of the day I do not think that it’s easy to go long of the Euro. Sure, if you are a short-term trader you could buy on a break of the top of the hammer and aim for the 1.7250 level, but at the end of the day I feel is much more comfortable to sell this market as the trend is most decidedly negative.

I believe that the 1.28 level above is massively resistive, and that it extends all the way to the 1.30 handle. That area of course is fairly large, being roughly 200 pips, but at the end of the day if we get above there I feel that the trend would have changed above that area. It’s very difficult to imagine that happening, at least not anytime soon.

Monetary policy coming out of Europe will continue to be loose

The monetary policy coming out of the European Central Bank should continue to be fairly loose, while the Federal Reserve has released a more hawkish than anticipated statement this week. Because of this, I believe that this market continues to go lower, and that we will ultimately break down below the 1.25 handle given enough time. A move below there could of course send this market much lower, and I still believe that it’s very likely that we do a so-called “round-trip” when it comes to the overall move, meaning that we will go to the 1.2050 level, where we started the uptrend that has now been shattered.

Going forward, I believe that every time this pair rallies, it will offer a nice selling opportunity. In fact, I believe that this is one of those markets that you can come to again and again in order to pick up short-term profits. Longer-term traders will of course prefer to short this market as well, but patience will be needed for that.