EUR/USD Signal Update

Yesterday’s signals expired without being triggered. The price did reach 1.2588 but did not produce any bearish price action when it arrived there.

Today’s EUR/USD Signals

Risk 0.75%

Entries should only be made between 8am and 5pm London time.

Short Trade 1

Short entry following bearish price action on the H1 time frame after a first touch of 1.2712.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride ensuring there is no risk left in the trade.

Short Trade 2

Short entry following bearish price action on the H1 time frame after a first touch of 1.2750.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride ensuring there is no risk left in the trade.

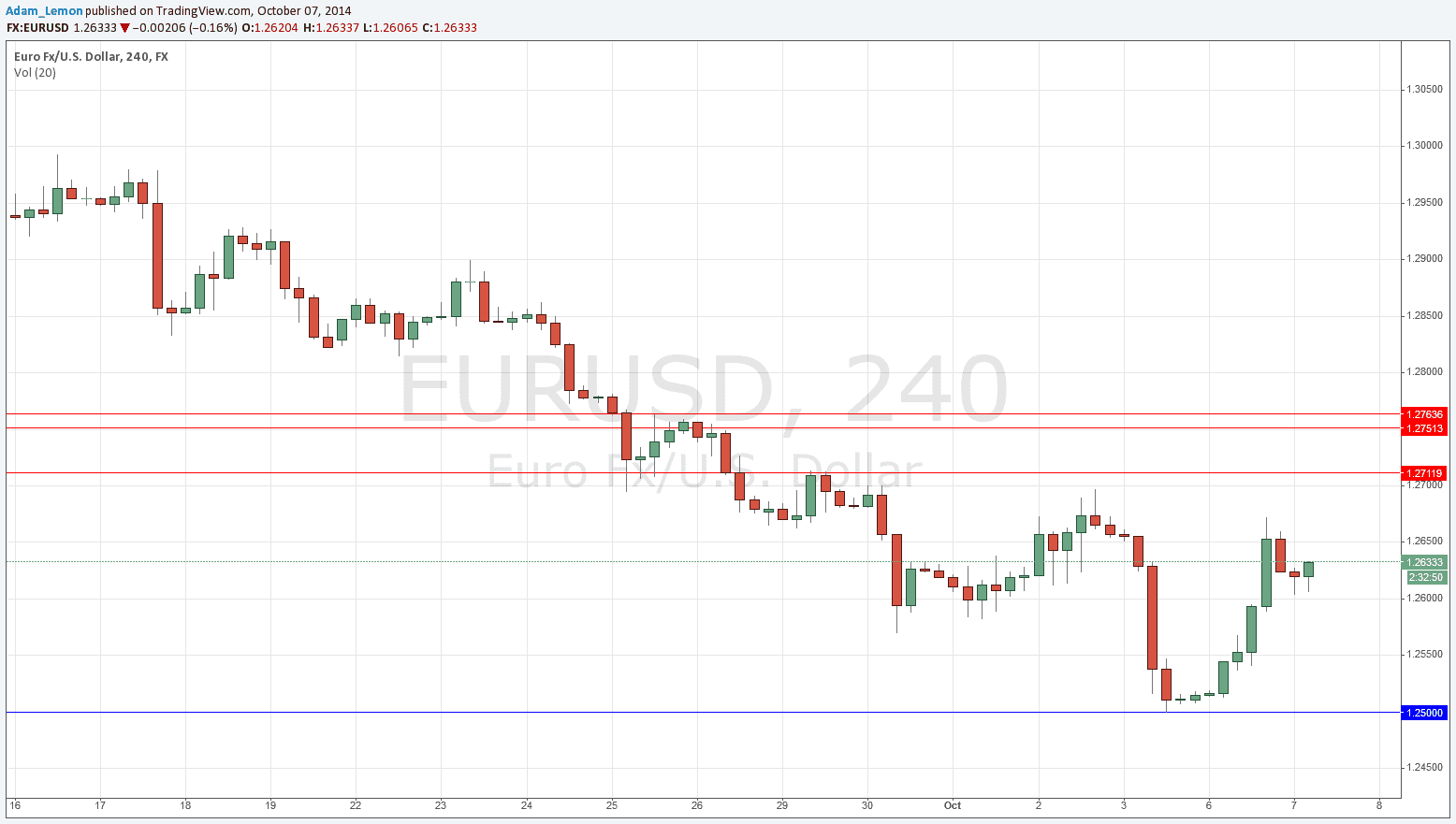

EUR/USD Analysis

I expected a quiet day yesterday and I was wrong. We saw instead a strong counter-trend move against the USD and it was manifested in this pair by a fairly steep upwards move that broke through the expected resistance level at 1.2588, fortunately without giving any signal to go short at that point. We rose as high as 1.2673 towards the end of yesterday’s New York session, 174 pips above Friday’s low! This is a significant move and is indicative that this whole week might be counter-trend.

One consequence of this sharp move is that there are no key levels now between 1.2500 and 1.2712 so it might be that we just chop around in this zone all week.

Despite the strong upwards move I would still look for short trades off 1.2712 and the zone from 1.2750 to 1.2763. My colleague Christopher Lewis also remains bearish.

There are no high-impact data releases scheduled for today which are likely to directly affect either the EUR or the USD. Therefore it is likely to be a quiet day for this pair.