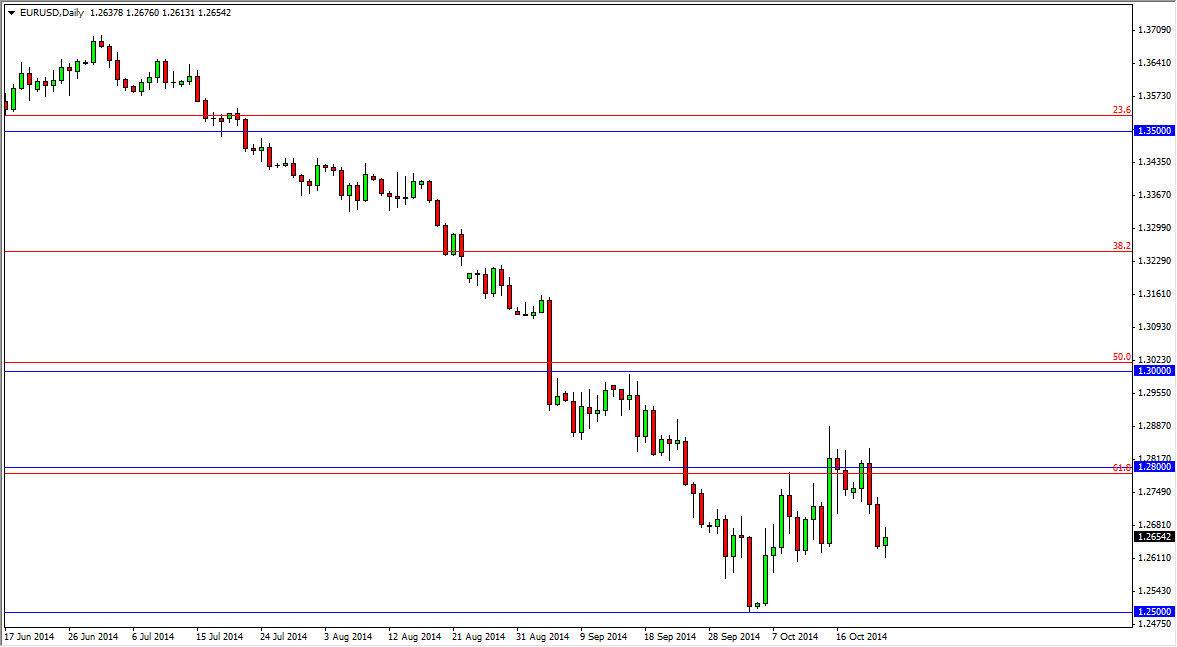

The EUR/USD pair did very little during the session to define itself during the day on Thursday, as we simply went sideways. The resulting candle is very flat and neutral, but at the end of the day all one can do is look at the overall trend and attitude of the market. On top of that, it is possible that we are just broken through the bottom of a bearish flag, and that of course should send this market going much lower as well.

I have been saying for some time now that breaking through the 1.28 level was in fact a very significant events. That region is the 61.8% Fibonacci retracement level from the overall uptrend that we have recently broken. That being the case, the market looks as if it is ready to continue lower, and as the technical analysis typically suggests I feel that this market is going to make a “round-trip” to the start of the uptrend. In other words, it’s very likely that we will eventually hit the 1.2050 handle, although it will certainly take quite a bit of effort and bearish pressure to achieve that. In other words, I plan on selling rallies going forward.

I will not fight this trend

The trend in this market has been rather brutal, and as a result of some is impossible for me to imagine buying the Euro at this point. The market will have to cross above the massive resistance barrier I see between the 1.28 level and the 1.30 level in order to be one that I’m willing to go long of. That seems very unlikely at this point in time, and most certainly isn’t going to happen anytime soon. With that, I look to short-term rallies as potential “value” in the US dollar, thereby making me sell this market. If we do get below the 1.25 level, I believe that it would be a massively negative sign and have me become much more aggressive to the downside.