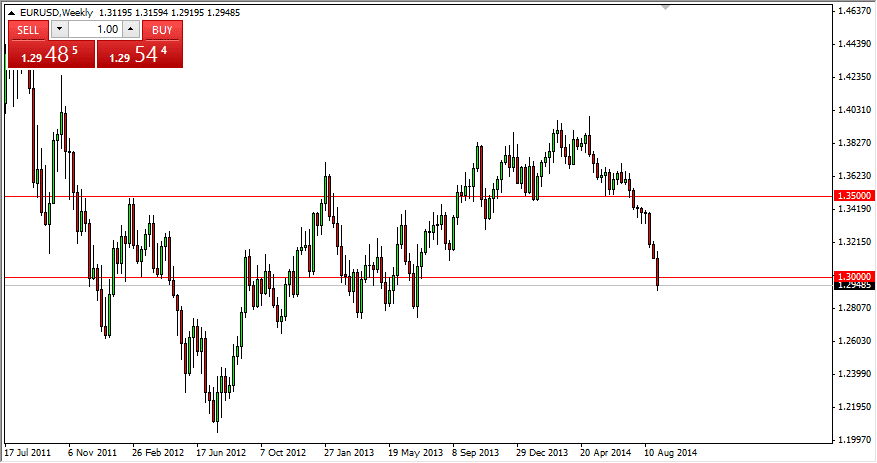

EUR/USD

The EUR/USD pair fell again this past week, as the European Central Bank did a surprise rate cut on Thursday. Because of this, the pair has fallen below the 1.30 level, and it appears that rallies will continue to offer selling opportunities. I have been saying for some time that my target is the 1.28 level, and there is nothing on this chart that suggests it won’t be realized. However, there will be bounces in a market that has fallen so hard. Those will be great times to pick up the Dollar “on the cheap.”

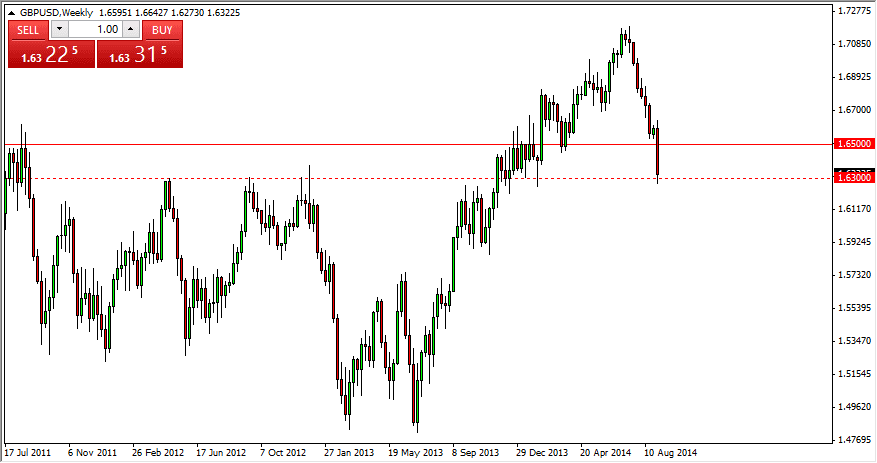

GBP/USD

This pair fell apart during the week as well, as we are far below the 1.65 level, and even tested the 1.63 area during the week. Because of this, I think that this pair will eventually reach the 1.60 handle, an area that is much more significant than the area that we have been to. Because of this, the markets will be a “sell on the rallies” market, much like the EUR/USD pair.

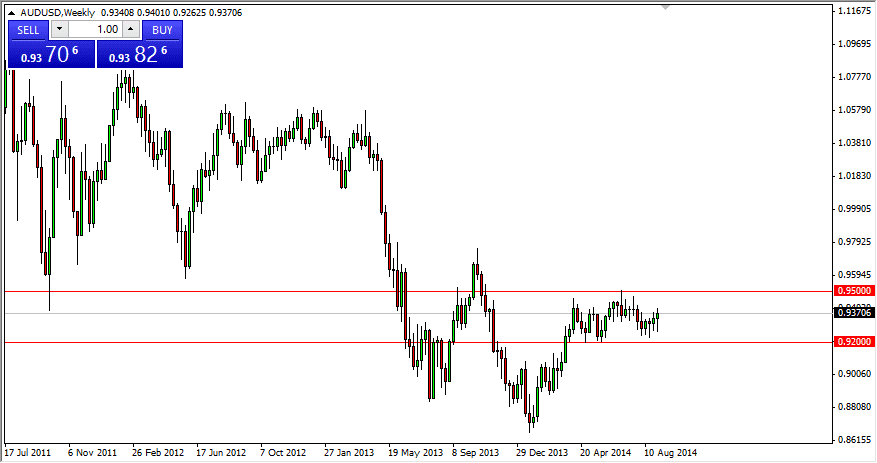

AUD/USD

The AUD/USD pair continues to trade in a range. This market is relatively tight, and I think that the 0.92 level below is supportive, and the 0.95 level is resistive. The market will continue to find breaking out difficult. With this, the market will continue to be the domain of short-term traders. The markets will not be helped by sagging gold markets, and as a result I look for a bit of a pullback from the 0.9450 level during the week, but we cannot expect much in the way of a breakdown quite yet. I think that is reserved for a break below the $1200 level in the gold markets.

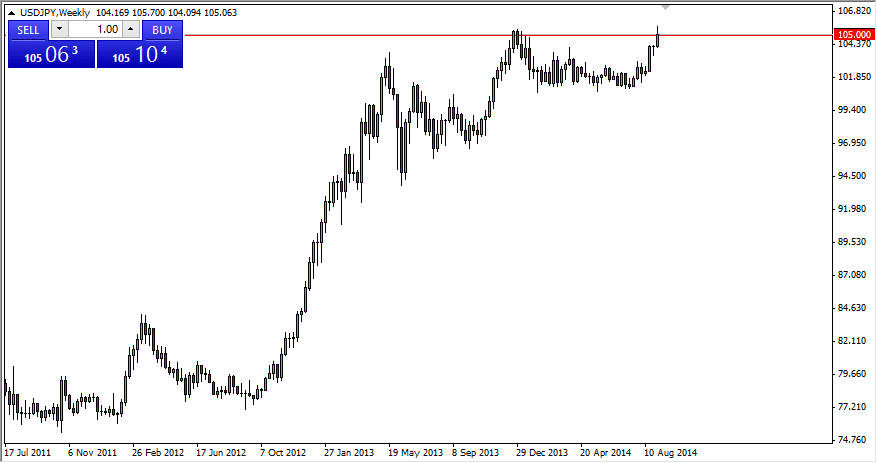

USD/JPY

The USD/JPY pair had a good week, but at the end of the day, we still hang about the 105 level. The market will continue to look supported, but there is a significant barrier in the 105.40 level, so it makes sense that we will simply bounce around just below, but time will tell. I believe that the market will eventually go to the 110 level, especially with the Bank of Japan being so loose with its monetary policy. Because of this, I am “long only” in this pair, and look at dips as buying opportunities.