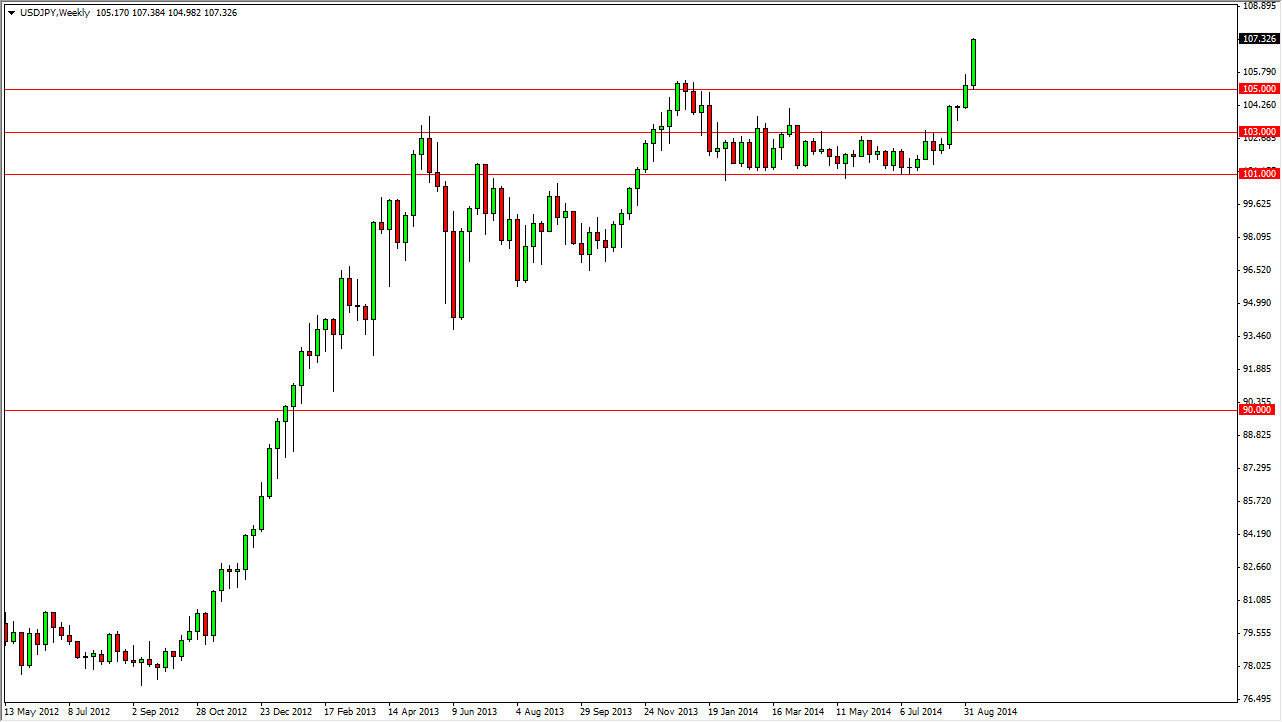

USD/JPY

The USD/JPY pair shot straight up during the course of the week, breaking the 107 level. I am most certainly bullish of this pair, and have been for quite some time but recognize that if you are not involved in this pair at the moment, you need to see some type of pullback in order to get long. Certainly, there’s no way to short this market now, and I fully believe that this market is going to the 110 level, probably sooner than most people realize.

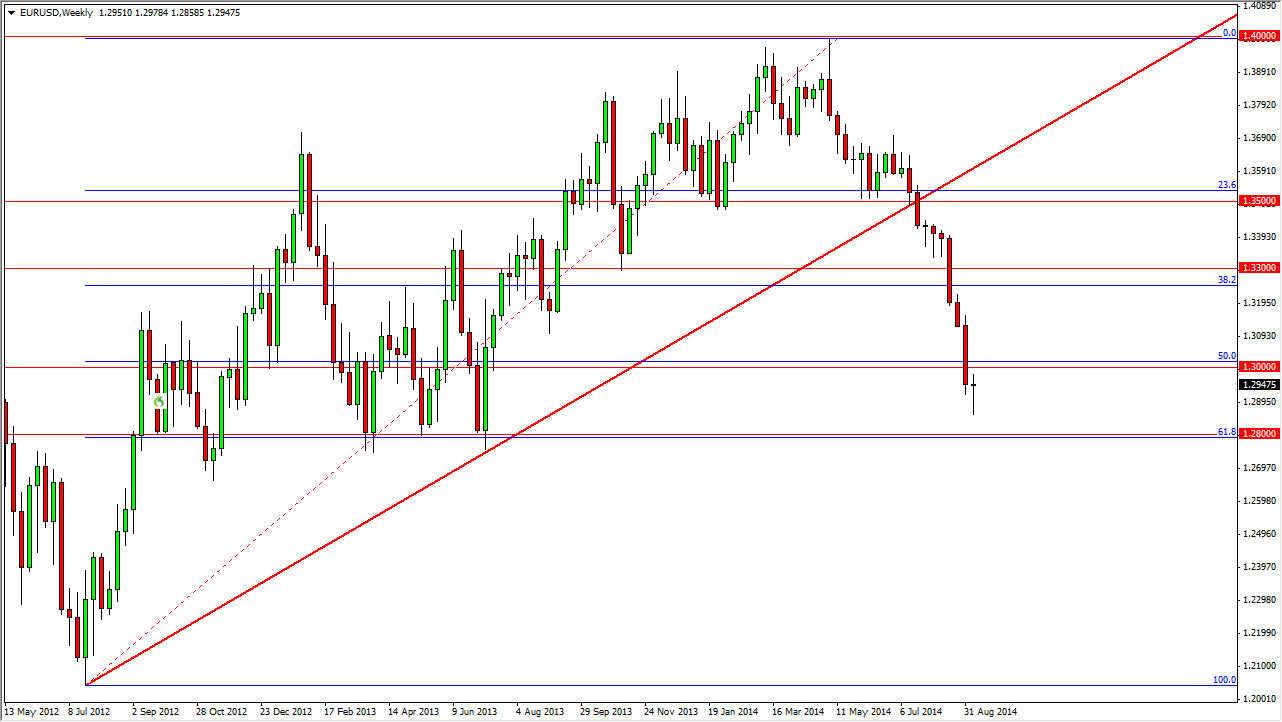

EUR/USD

The EUR/USD pair did something that I didn’t expected to this past week: form a nice-looking hammer. I think that we have gotten close enough to the 1.28 level in order to find enough support to go higher. I think this might be a shorter-term move, but there’s no reason to believe that the market won’t skip above the 1.30 handle, and probably head back towards the gap at the 1.3250 region. That being the case, I believe that a break above the top of the hammer and the 1.30 level is a reason to start buying for the next couple hundred pips.

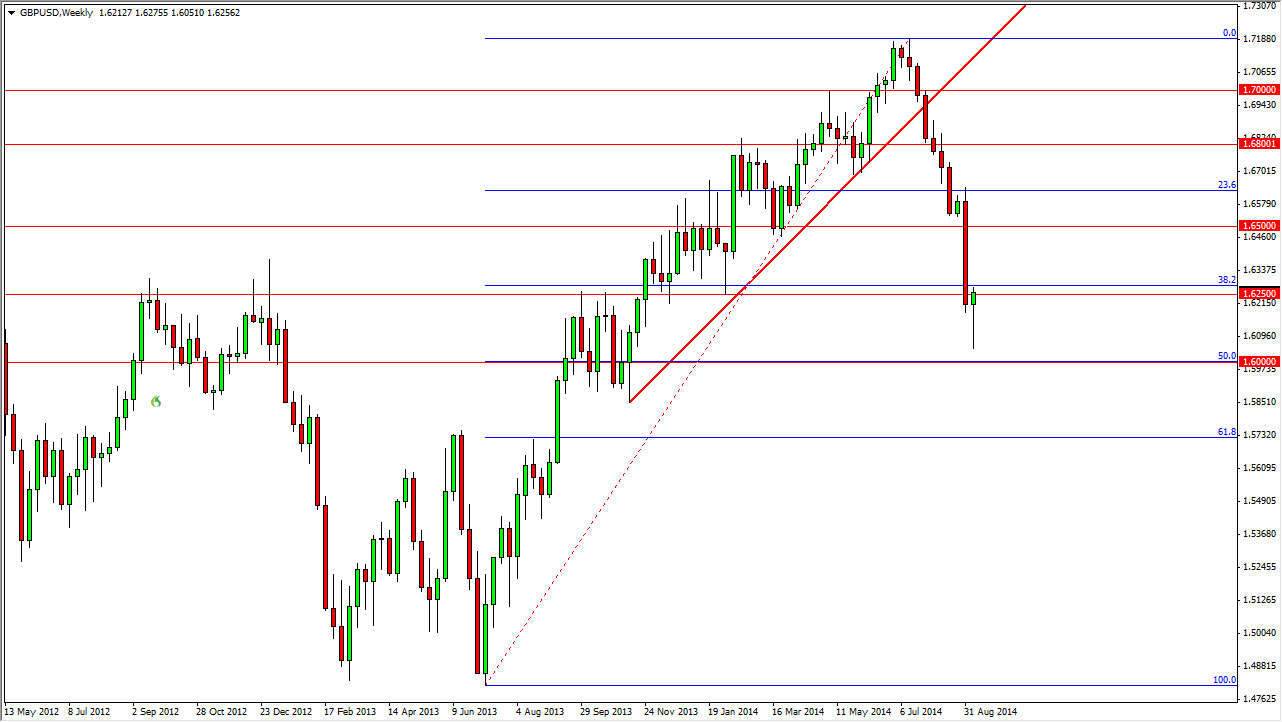

GBP/USD

The GBP/USD pair has fallen off of a cliff lately. However, you can see that we have formed a massive hammer for the week. It formed the just above the 1.60 handle, and I believe that finally we are starting to see some people look at the possibility of the Scottish not leaving the United Kingdom. If that’s the case, the British pound will get massive buying pressure. I think that’s what we are getting ready to see as the referendum vote is on Thursday. I think the Scottish are going to stay, and therefore the British pound is a buy above the top of the hammer for the week.

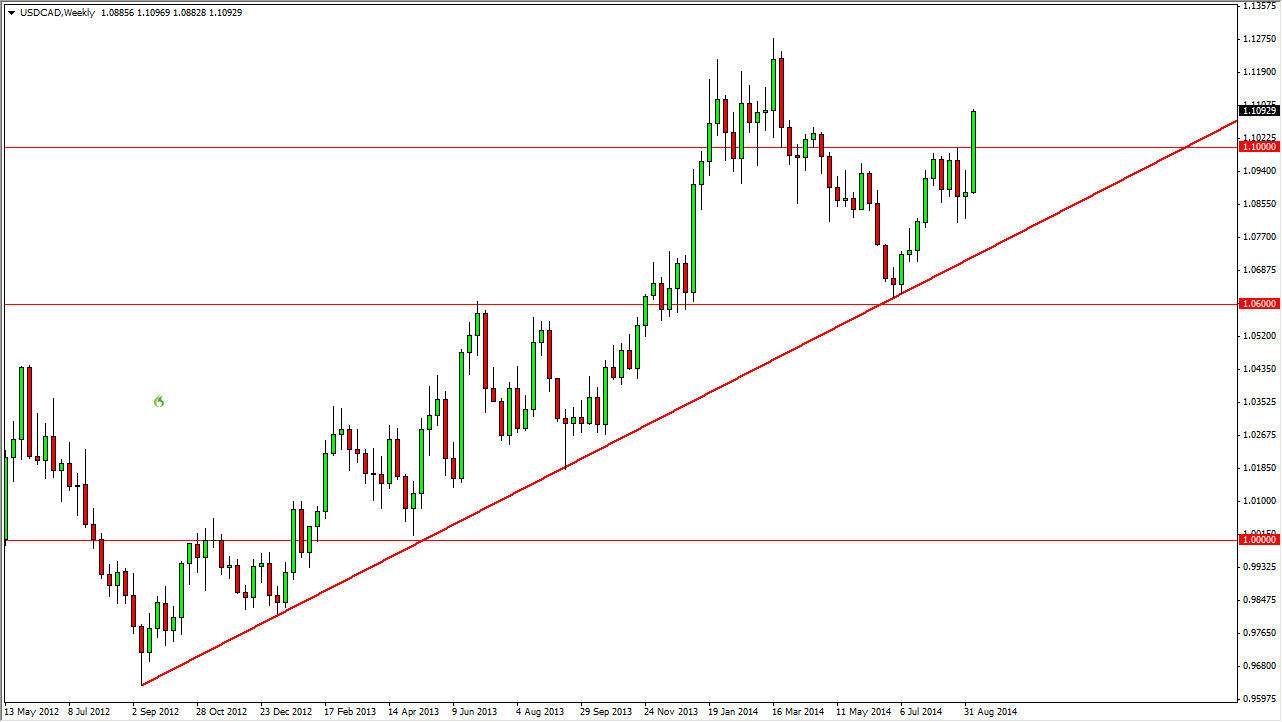

USD/CAD

The USD/CAD pair is very bullish, and over the last week finally broke out above the 1.10 level on a weekly close. Because of this, I think that the market will be a “buy on the dips” type of market, and as a result I am very bullish this market and will continue to buy it every time it pulls back. Ultimately, I think this market goes to the 1.15 handle.